From CoinShares Research Blog by Max Shannon

SIMD-228: An Overview

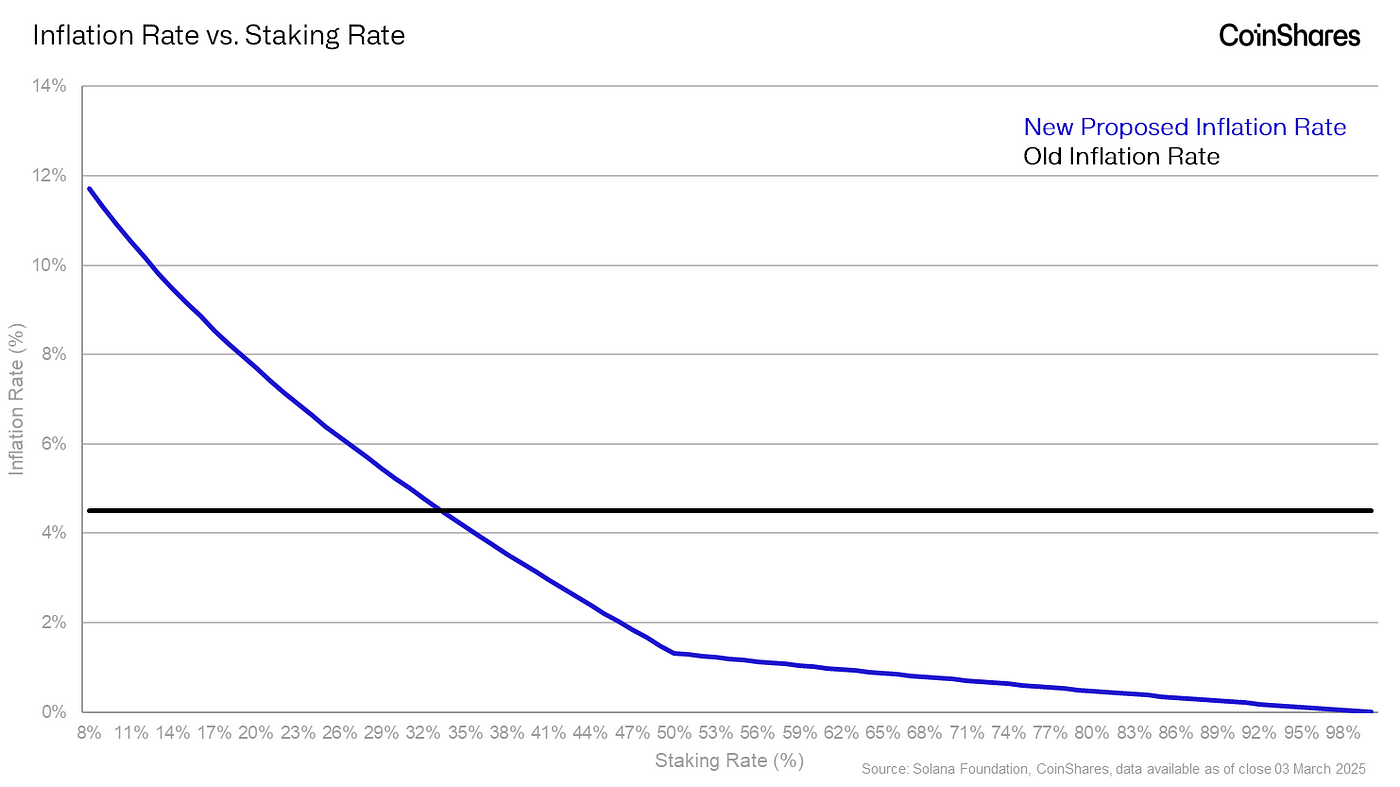

SIMD-228 is a proposal designed to have a dynamic inflation rate, set by the percentage of the circulating supply that is staked, as opposed to having a static inflation rate.

Understanding the Proposed Inflation Adjustments

It is based on the premise that the current inflation model — 4.5% and decreasing by 15% annually until reaching 1.5% — remains too high and requires adjustment. The proposal seeks to make the inflation rate more adaptive, using a target staking ratio as a key determinant.

Voting Timeline and Implementation

The vote is scheduled for 7th March; however, if the vote passes, implementation may take around 100 days (50 Epochs) due to a careful rollout of a change of this magnitude.

Arguments in Favour of SIMD-228

Supporters of SIMD-228 argue that the potential drawbacks — such as greater centralisation due to reduced staking profitability and heightened security risks during bear markets — are outweighed by its benefits. These advantages include increased DeFi activity driven by a lower ecosystem risk-free rate (staking yield), which reduces the hurdle rate for applications like lending and borrowing to generate returns. Additionally, lower daily token emissions decrease selling pressure, thereby enhancing the asset’s attractiveness.

The prevailing sentiment among proponents is that while the proposal is not perfect, it represents a step in the right direction and can be refined over time. Many concerns have been addressed with the argument that perfection should not hinder progress — incremental improvements are preferable to maintaining the status quo.

Furthermore, the recent implementation of SIMD-96, which sent 100% of all priority fees to validators (instead of 50% burned) reduced Solana’s burn rate to approximately 1%, has led to an increase in inflation. This makes SIMD-228 even more appealing as a mechanism to counterbalance this effect.

Arguments Against SIMD-228

Opponents of SIMD-228 are primarily smaller stakers who may experience a reduction in their staking rewards. Based on total revenues, the proportion of revenues derived from emissions, and voting costs, it is highly probable that at least 100 smaller validators could exit the network, according to sources in the industry. Institutional staking service providers, which generate the highest revenues under the current staking model, are also likely to oppose the proposal due to concerns over reduced staking profitability and its potential impact on network decentralisation.

Key Takeaways

- What? SIMD-228 proposes a dynamic inflation model for SOL, adjusting the rate based on market conditions.

- Why? The current inflation trajectory is considered too high and insufficiently responsive to market dynamics.

- Who favours? DeFi community and investors seeking reduced token emissions.

- Who opposes? Solo stakers and large institutional validators reliant on high staking revenues.

- When? Voting occurs on 7th March, though implementation could take months.

(written by Luke Nolan and Max Shannon)

All Comments