From ournetwork

Lombard 🏦

👥 Ian Unsworth | Website | Dashboard

📈 The Adoption of LBTC is on the Rise as 62% of the Token Supply — $1.2B — is Being Used in DeFi

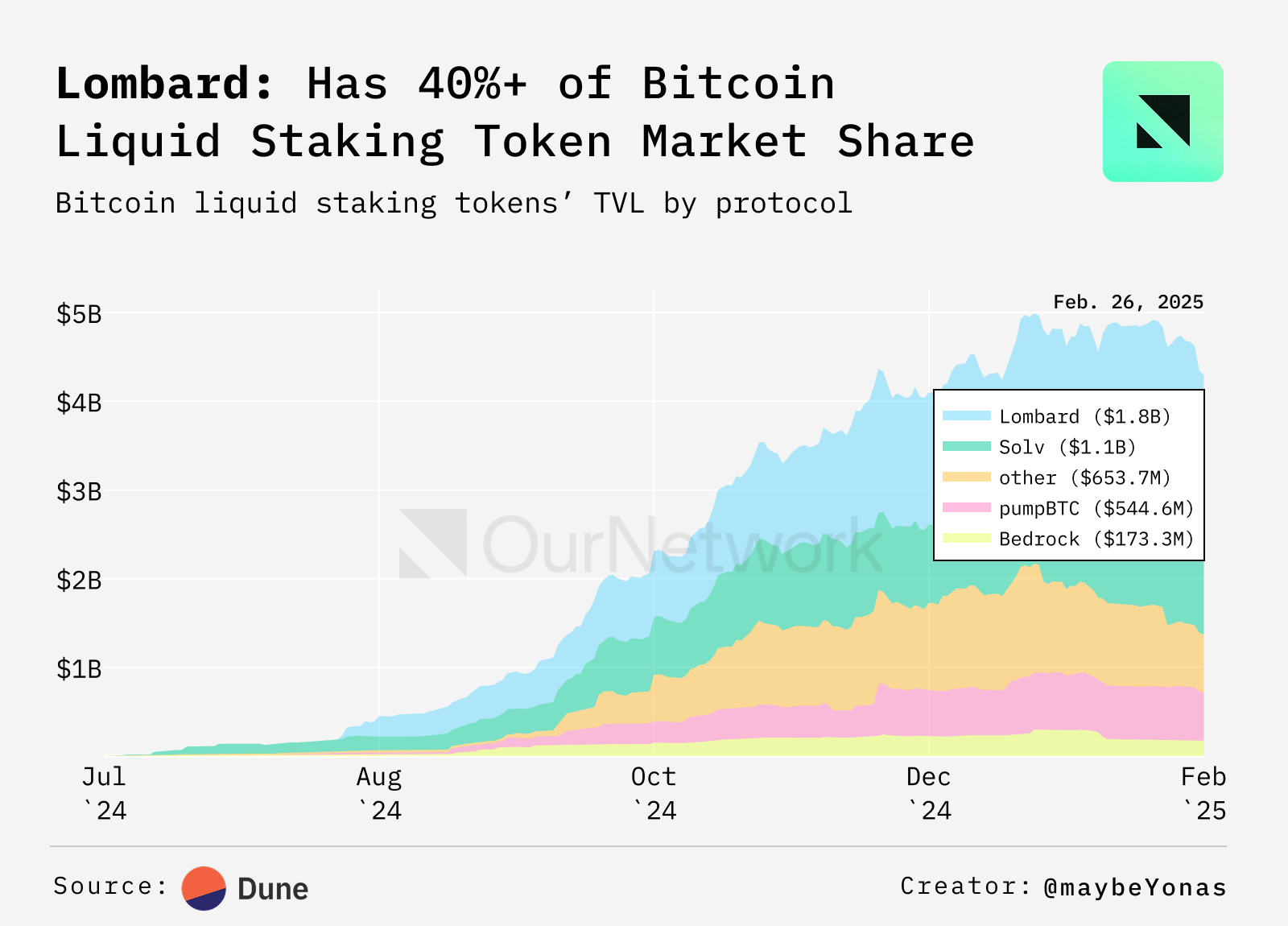

- Lombard transforms Bitcoin into a productive asset with LBTC, a secure, liquid staked token via Babylon that unlocks Bitcoin's potential to be productively utilized within DeFi. With approximately $2B in total value locked (TVL), Lombard's LBTC is leading the pack across the Bitcoin liquid staking token (LST) landscape with a dominant 40.6% market share. With analogous LST products like stETH, JitoSOL, and weETH across various networks, one principle remains consistent: liquidity consolidates amongst a singular asset.

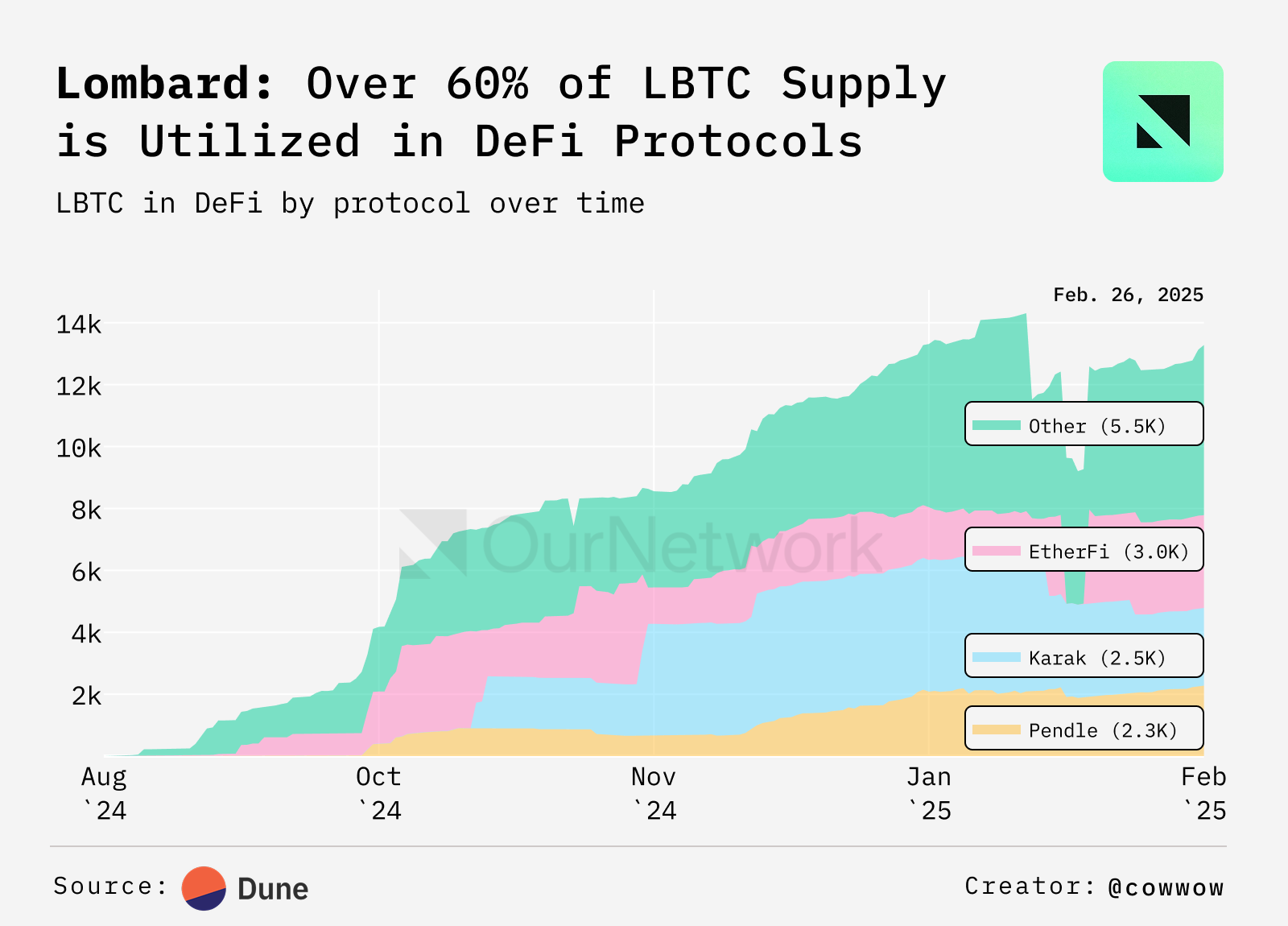

- These inflows are attracting a particular kind of market participant — the kind who wishes to utilize Bitcoin onchain in DeFi. Currently 62.49% of the LBTC supply is being productively utilized across DeFi protocols like Aave, EtherFi (Vault), Pendle, and Morpho.

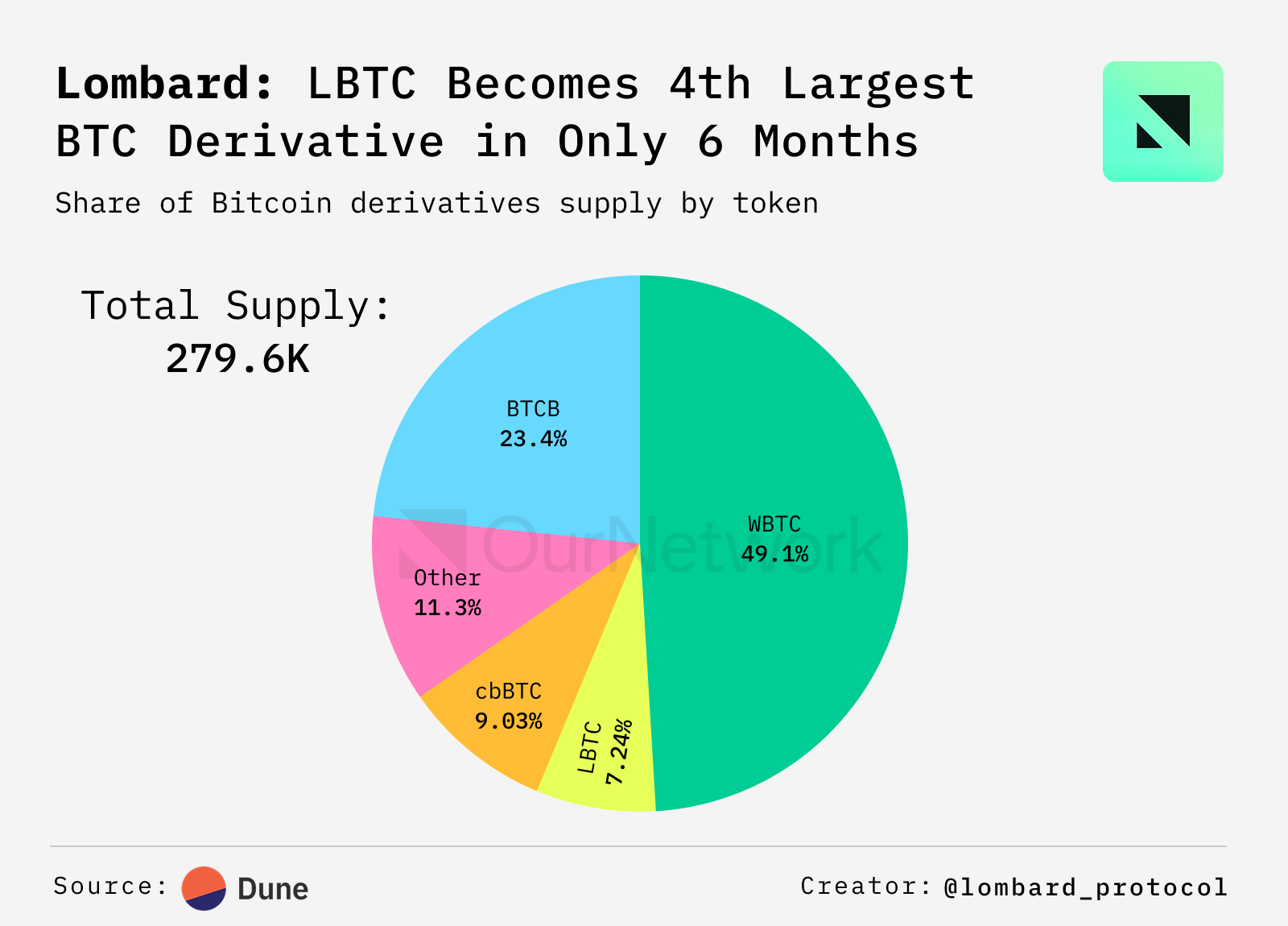

- Despite being only six months old, LBTC has already become the fourth largest Bitcoin derivative outside of WBTC, BTCB, and Coinbase's cbBTC. LBTC is notably close to flipping cbBTC as well. Babylon deposits are currently closed, but once deposit caps are fully lifted, LBTC could potentially flip WBTC.

cbBTC 🔵

👥 Seoulcalibur.eth | Website | Dashboard

📈 cbBTC Continues to expand its presence with 28k cbBTC Circulating Across Four Chains

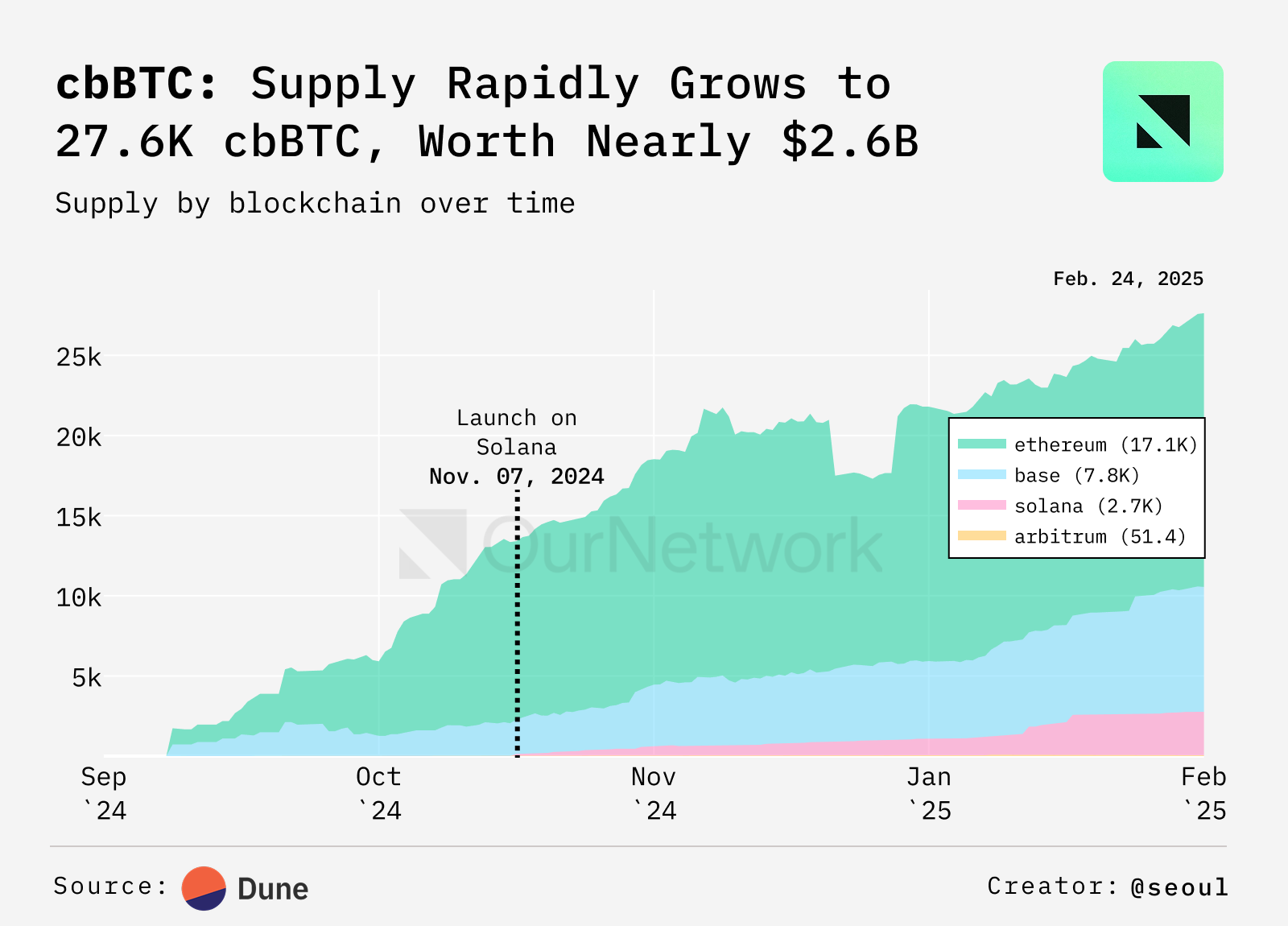

- After launching in September 2024 on Ethereum and Base, cbBTC's circulating supply rapidly grew to $2.6B (~27.6k cbBTC) driven by subsequent expansions to Solana and Arbitrum along with growing adoption within the Base ecosystem. Created by Coinbase to enhance BTC utility, cbBTC is steadily capturing market share across multiple chains. Despite Coinbase’s controversial delisting of wBTC, cbBTC continues to gain adoption, positioning itself as a key player in the wrapped Bitcoin ecosystem.

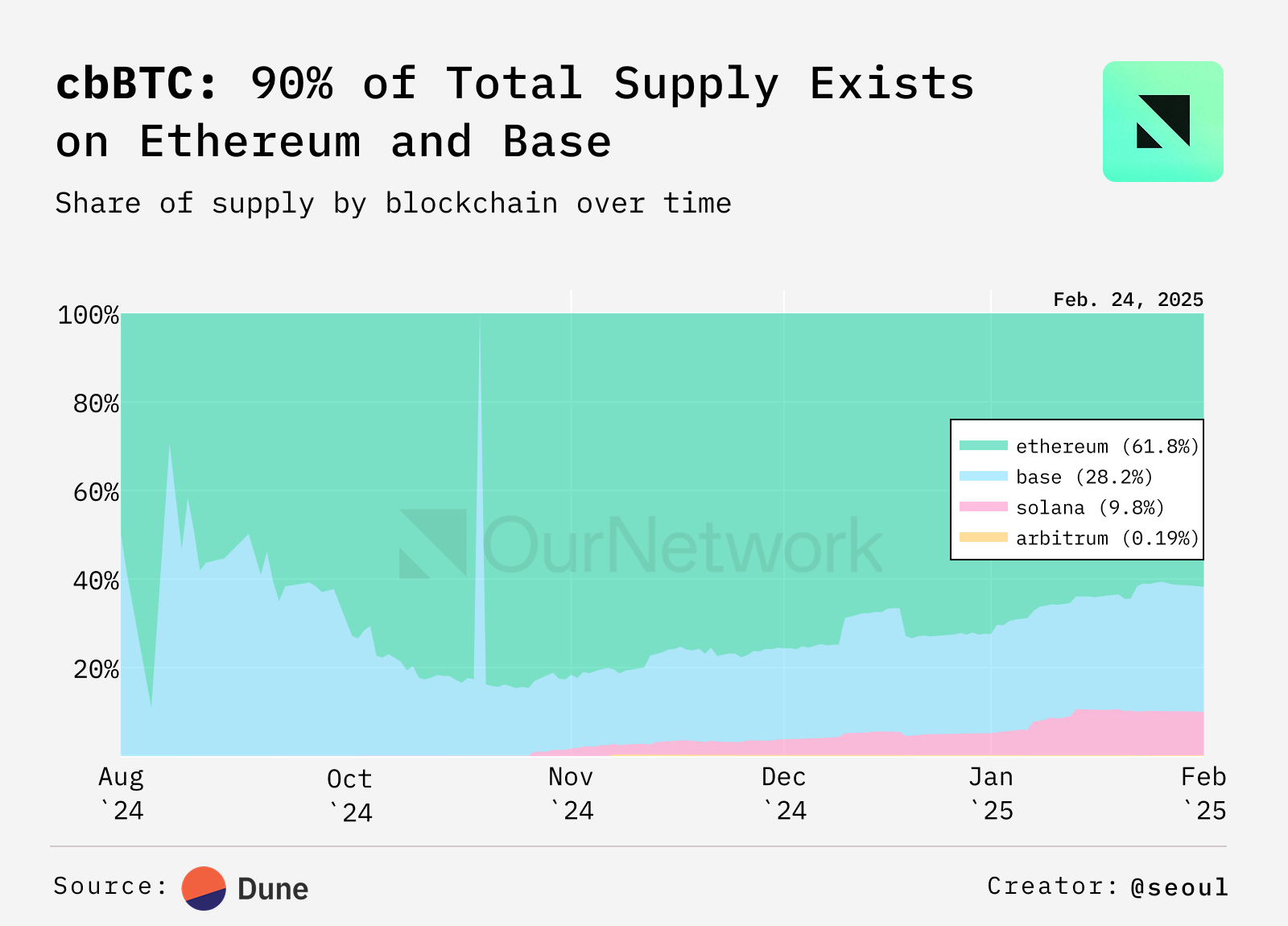

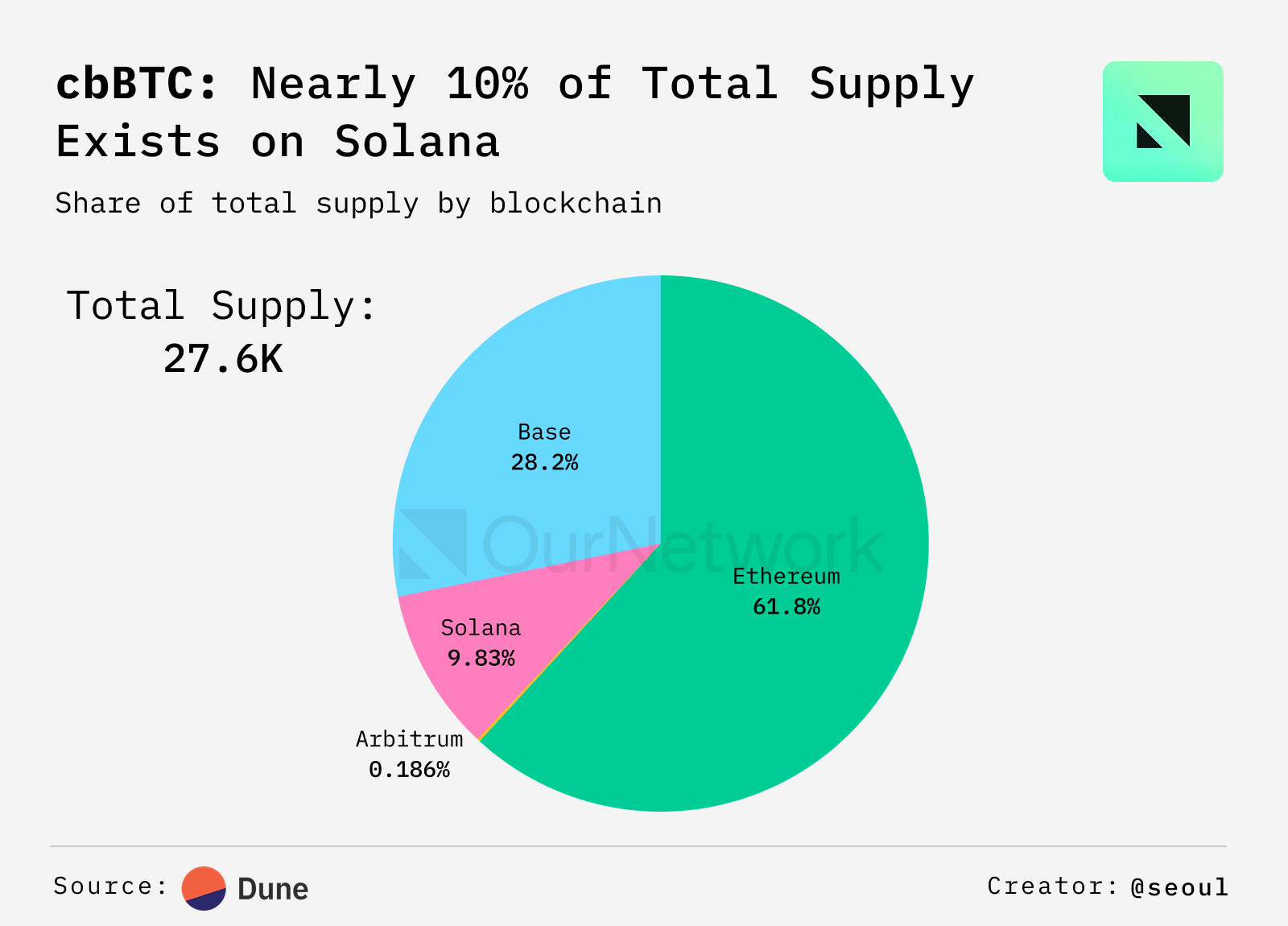

- Despite its initial launch on Ethereum and Base, cbBTC’s circulation on Solana has steadily increased to ~10%. Currently, supply on Ethereum dominates with 61.8% followed by Base at 28.2%. Arbitrum’s share of the cbBTC supply remains minimal at around 0.2% of the total supply.

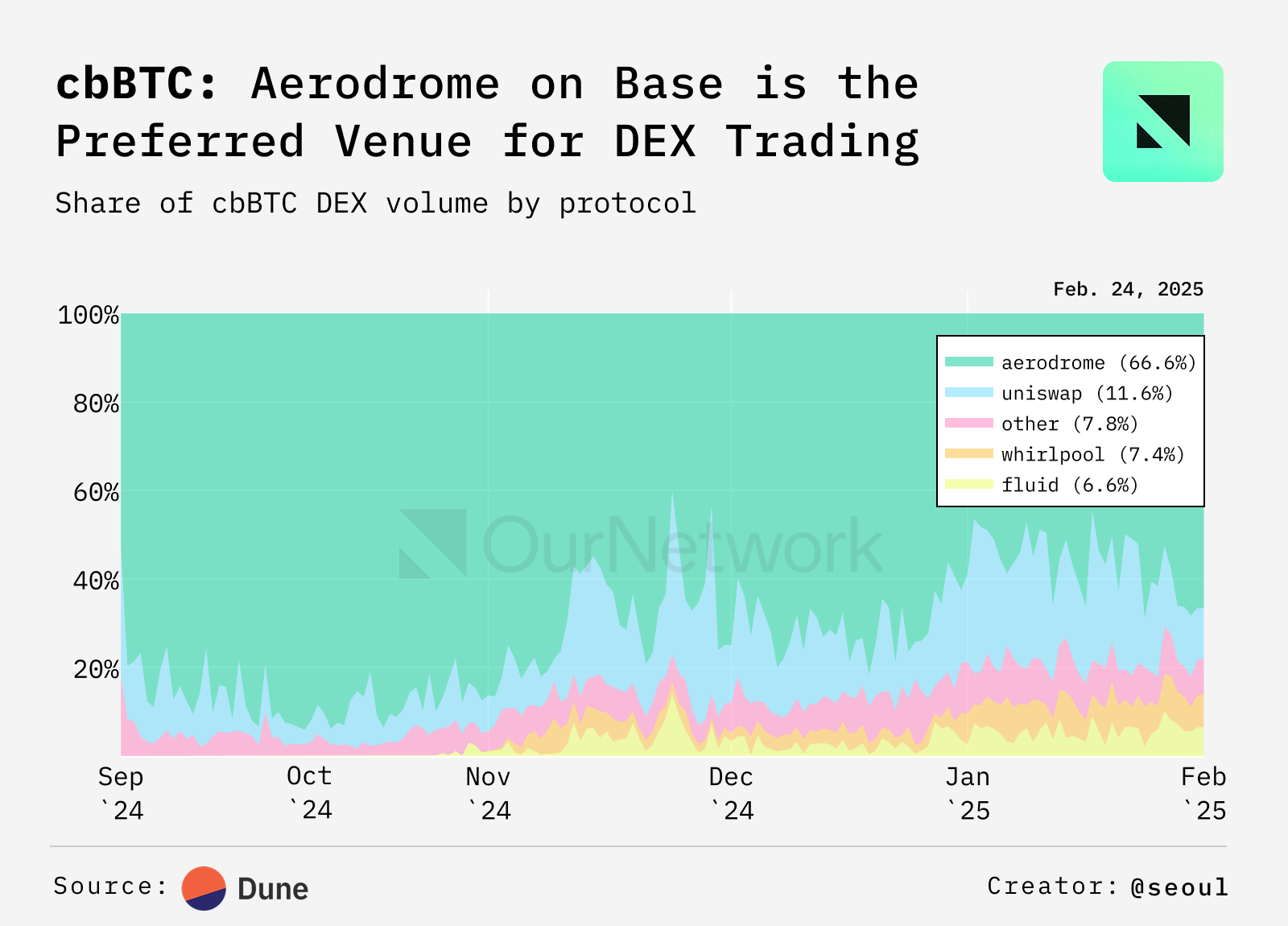

- Despite its dominance on Ethereum, decentralized exchange (DEX) volume is led by Base’s native DEX, Aerodome. The DEX’s ETH-cbBTC and USDC-cbBTC pools are at $38.8B followed by Uniswap at $10.9B. Usage appears concentrated on Base due to incentives, and it will be interesting to follow cbBTC’s competition in the wrapped Bitcoin market.

BoB ₿

👥 Daedalus | Website | Dashboard

📈 Despite Market Volatility and Downward Momentum, BoB's Onchain Activity Remains Steadfast, with the Protocol's TVL Putting it Among the Top 10 L2s

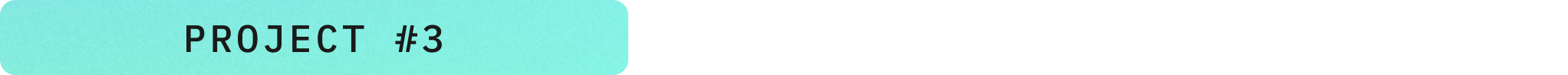

- With $226M in TVL, BoB has further consolidated itself as the mainstay in Bitcoin’s nascent L2 space. Solv Protocol, the Bitcoin staking platform, now makes a significant part of its TVL ($137.9M). Bob's total TVL puts the L2 in the top 10 in those terms, according to L2BEAT, making BoB the first hybrid L2 among the ranks.

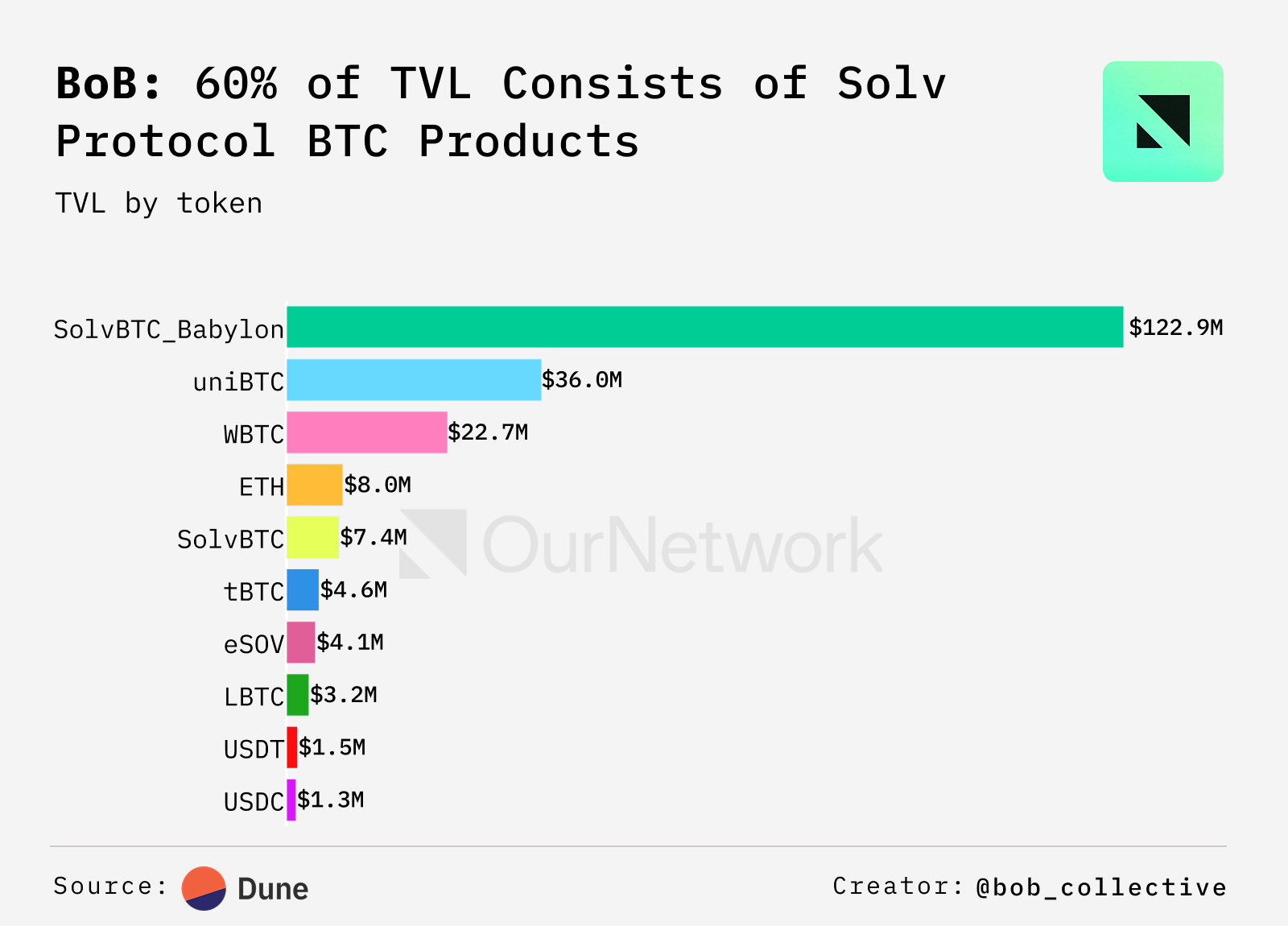

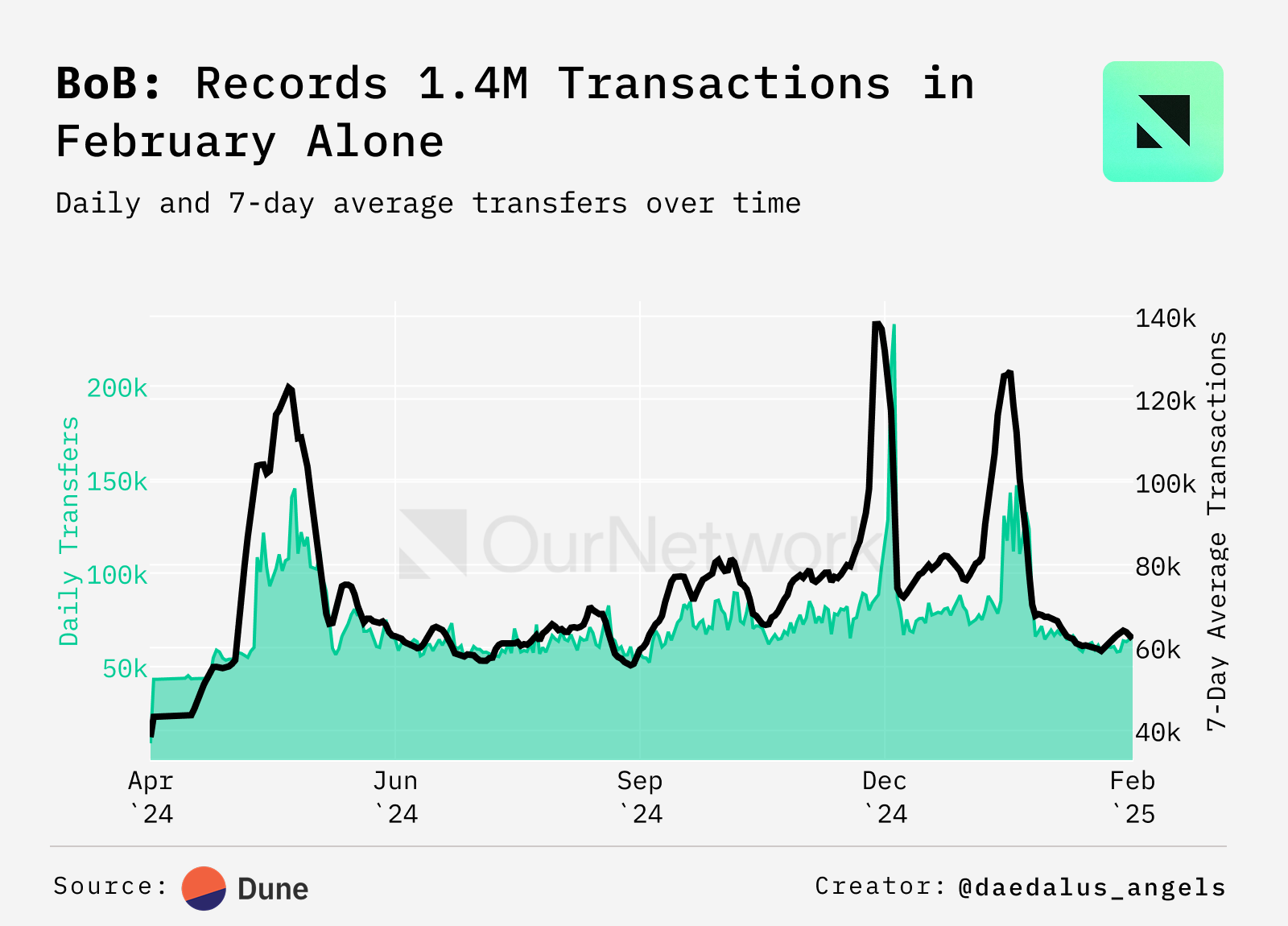

- Despite volatile market conditions and competing metas, BoB’s key onchain metrics haven’t regressed following the mainnet launch and the recent quieting of the ‘DeFi on Bitcoin’ narrative. For the month of February alone, BoB has recorded 46K unique users and 1.4M transactions.

- At the time of writing, BoB continues to maintain an average of 65,000 daily transactions.

Rootstock 🌱

👥 Guilherme Wenceloski | Website | Dashboad

📈 Rootstock, Buoyed by Shared Security from Bitcoin-Native Mining, Maintains $200M+ TVL

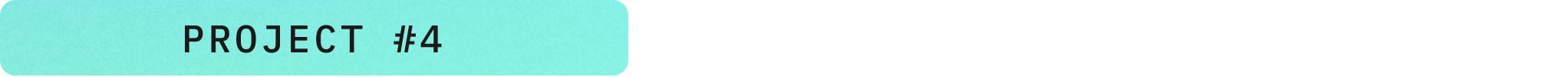

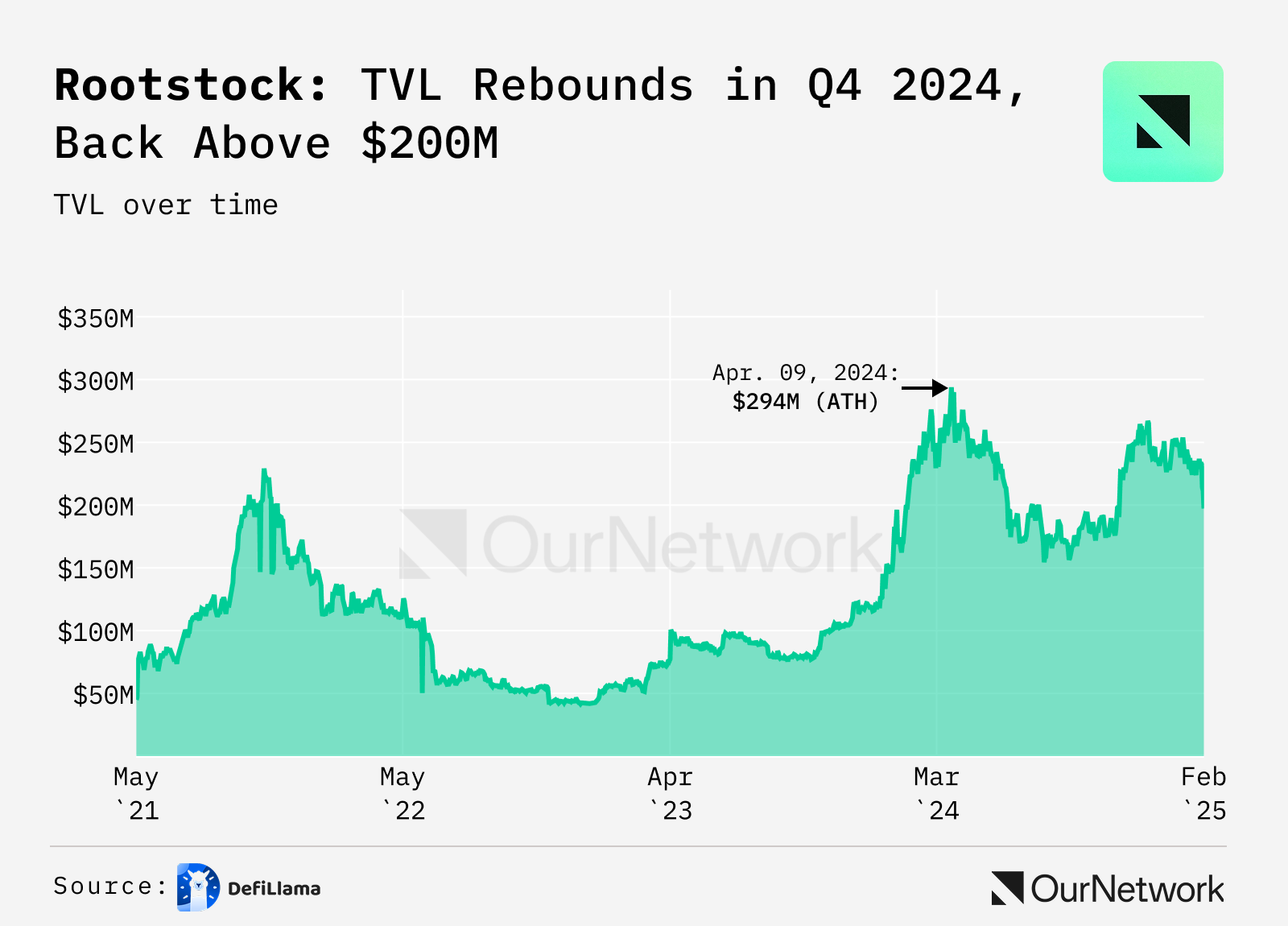

- Rootstock is an EVM-compatible Bitcoin sidechain which is secured by approximately 80% of Bitcoin's hashrate through merge-mining with pools like Foundry. Through strategic integrations, growing institutional interest, and a thriving community. The network hit an all-time high of $294M TVL in April 2024 and has remained above $200M since then.

- Merged mining, with pools like Foundry, secures Rootstock with ~80% of Bitcoin's hashpower today, more hash power than the Bitcoin network itself had in October 2024. Miners gain rBTC fees, strengthening both Bitcoin's economy & Rootstock's security.

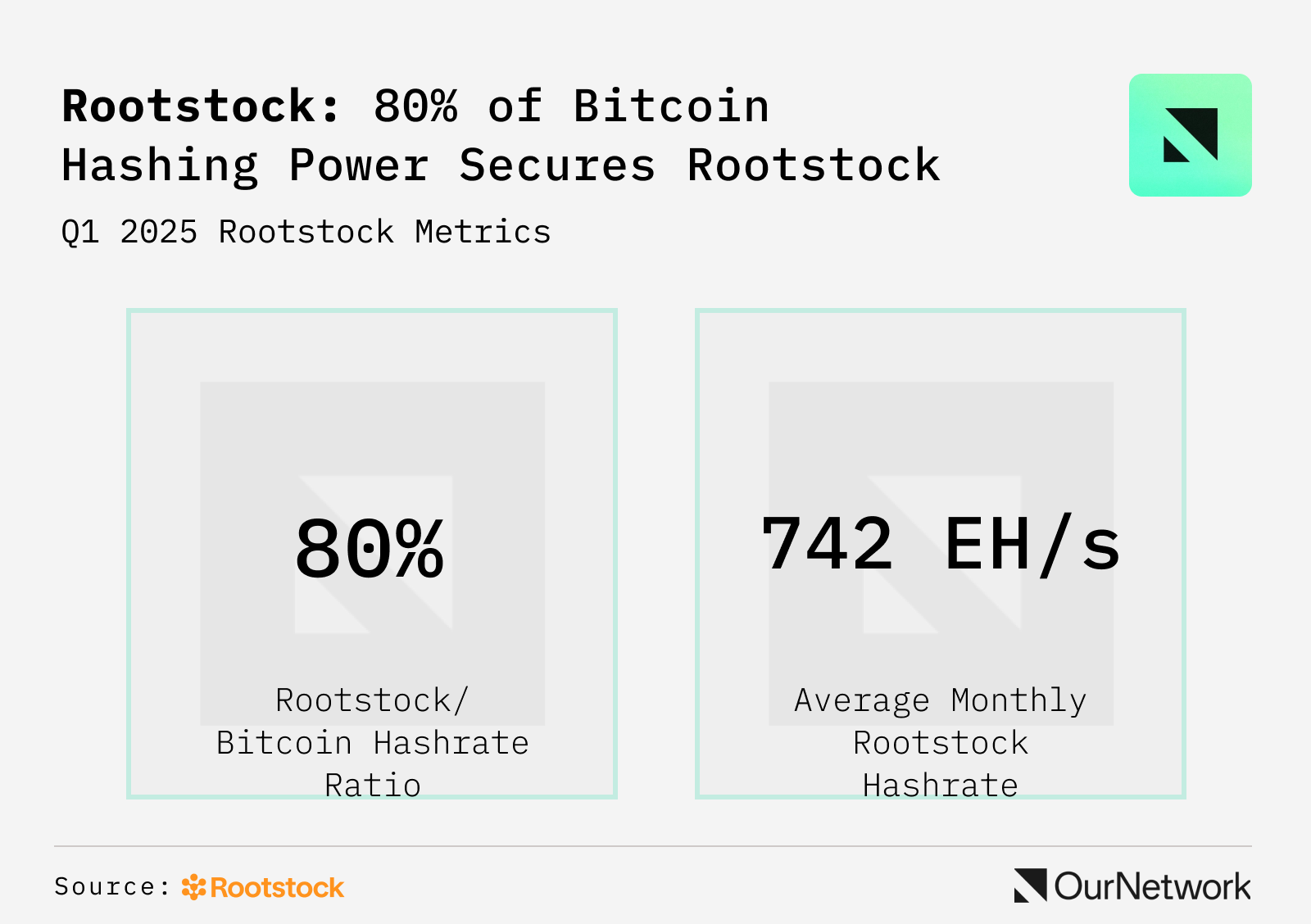

- Bitcoin DeFi on Rootstock, secured by Bitcoin's hashpower, is community-driven — staked RIF, the token used to govern Rootstock's DAO, jumped from 6.6M in November 2024 to 11.8M in February 2025, showing strong community support for Bitcoin-secured DeFi innovation.

SatLayer 🟨

👥 Ian Unsworth | Website | Dashboard

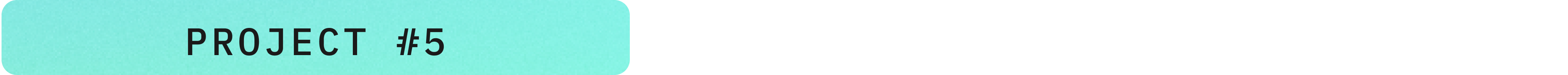

📈 Early Deposits Provide a Glimpse of the Demand Appetite for Bitcoin Restaking on SatLayer through Babylon-based Bitcoin LSTs.

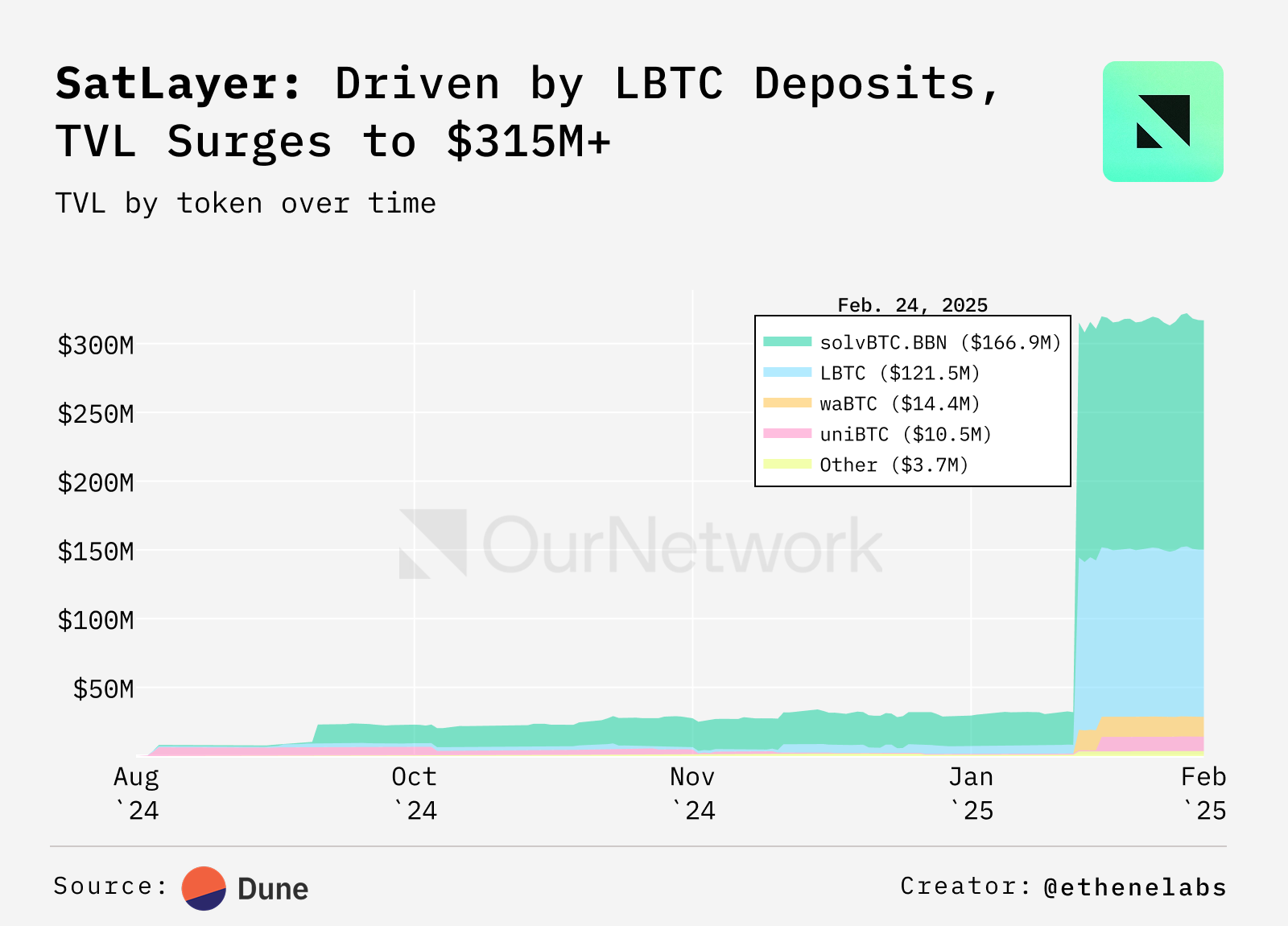

- SatLayer is building a universal security layer that maximizes the power of Bitcoin, enabling BTC stakers to secure any proof-of-stake (PoS) networks or applications as a Bitcoin Validated Service (BVS). SatLayer currently has a TVL of around $312M and is uniquely positioned to serve the Bitcoin ecosystem through their partnership with Babylon, a protocol itself over $4.5B, as their designated restaking partner.

- SatLayer is currently open for deposits on both Ethereum and BNB Chain. So far, two Babylon LSTs constitute the overwhelming majority of their deposits. Between Lombard's LBTC, and Solv's solvBTC, combined they account for 91% of TVL at $120M and $164M respectively.

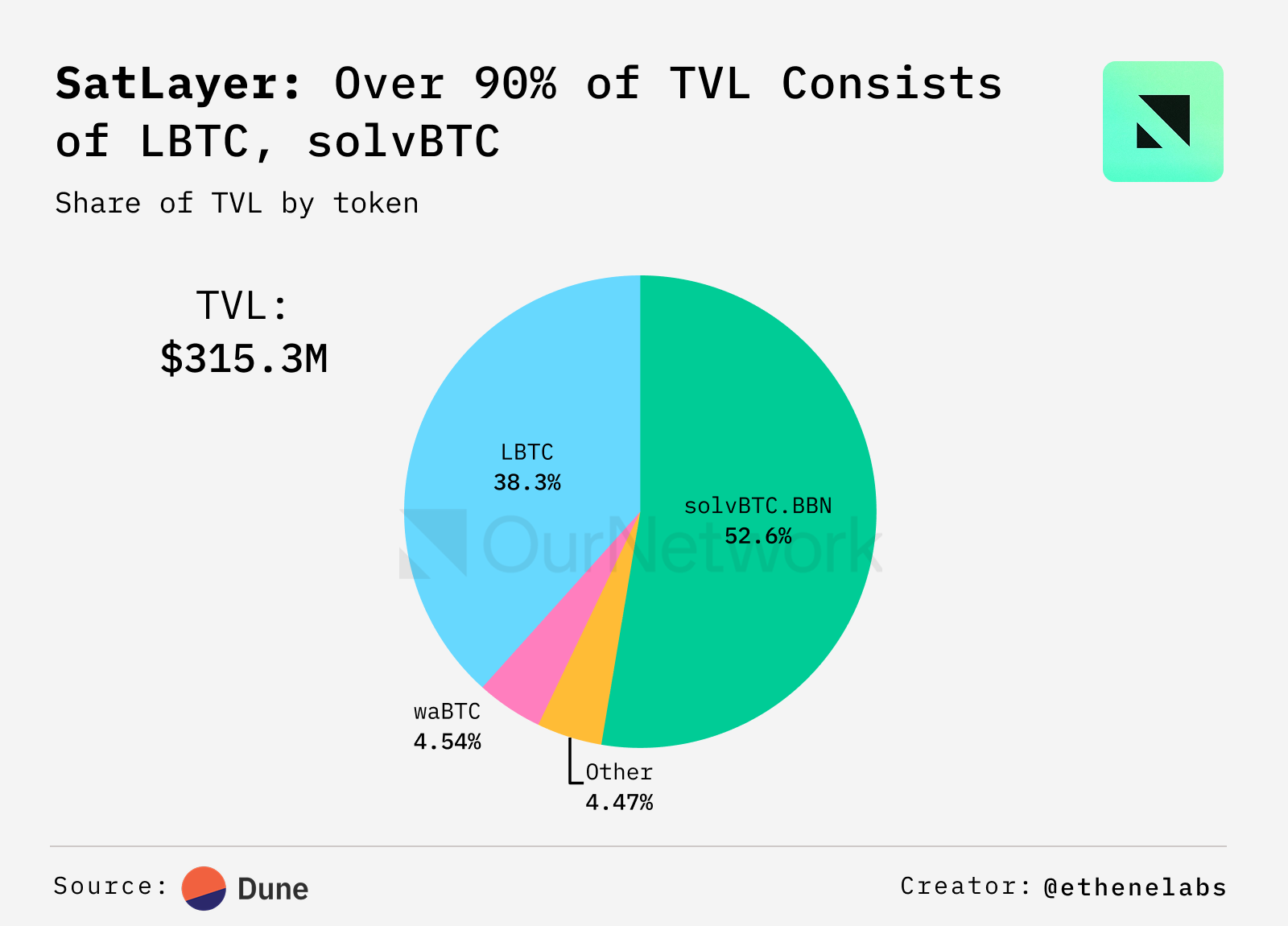

- Despite BNB Chain-based deposits accounting for just 0.73% of the dollar amount of total deposits, there have been tens of thousands more deposit transactions versus Ethereum. While BNB transactions are much cheaper than Ethereum, this discrepancy could also signal geographical demand for Bitcoin innovations.

All Comments