ournetwork xyz

EigenLayer 🟣

👥 Diego Cabral | Website | Dashboard

📈 EigenLayer Continues to Lead the Restaking Sector

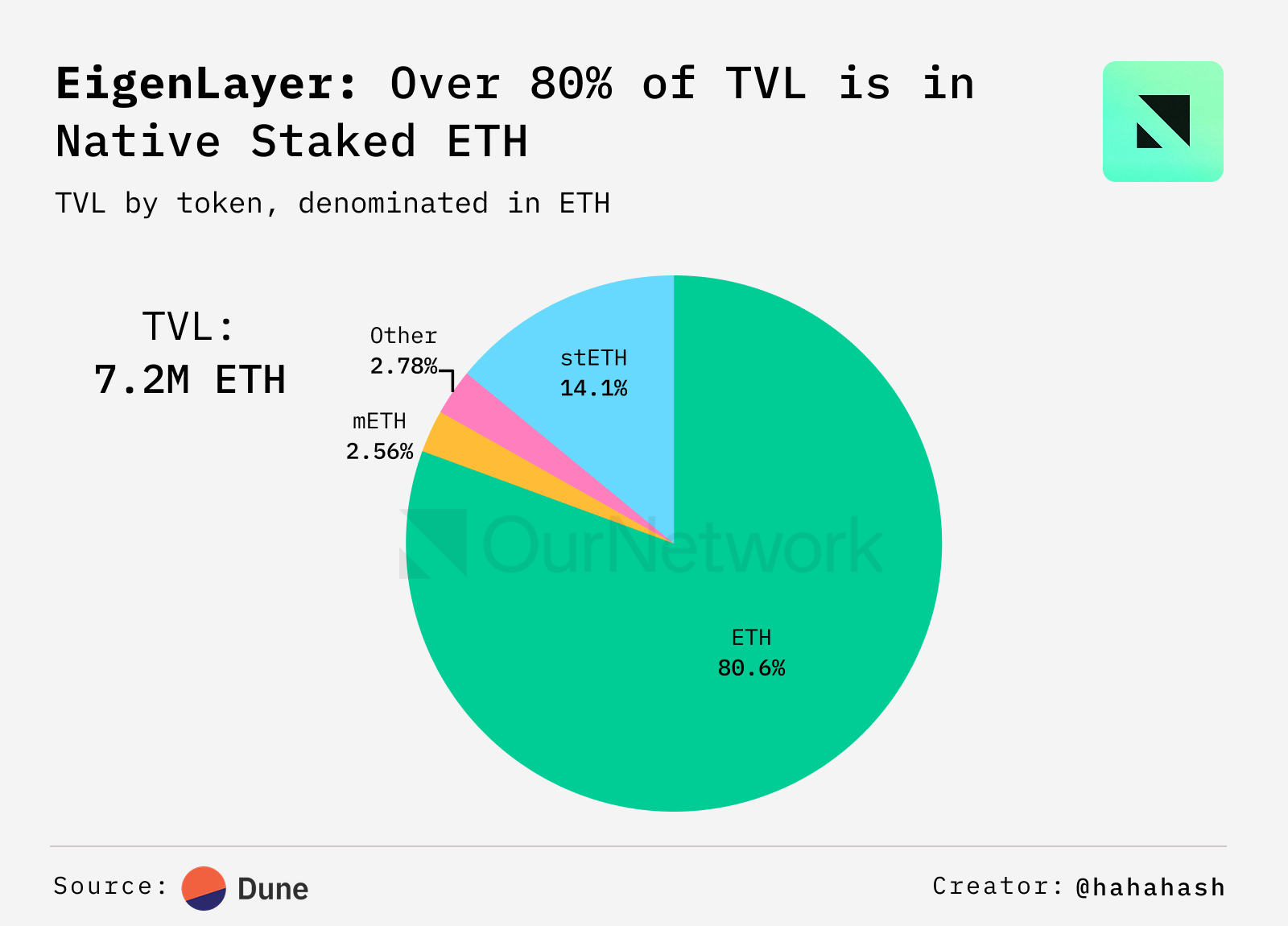

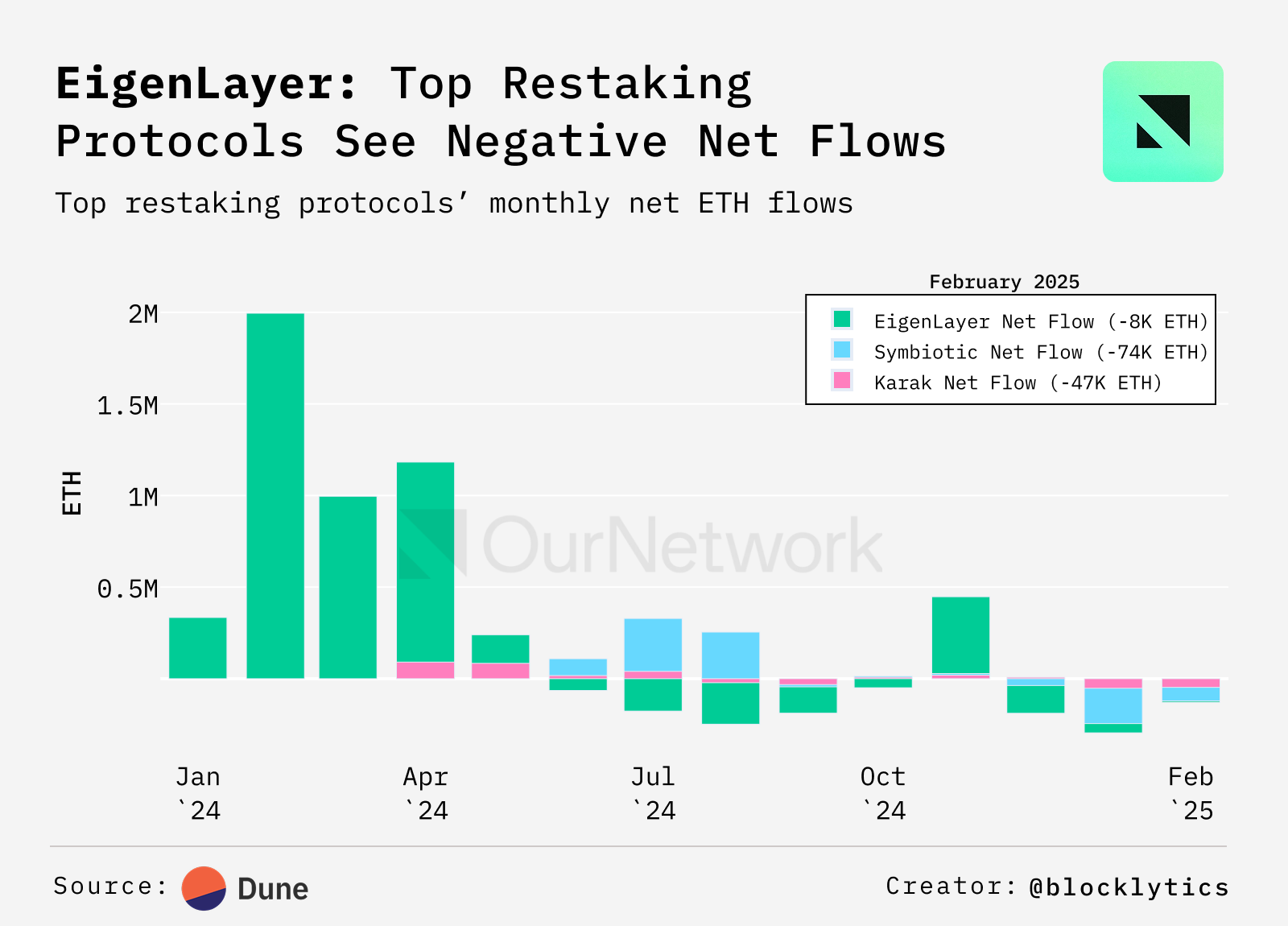

- After a surge in deposits between February and April 2024, total value locked (TVL) for Eigenlayer, the leading restaking protocol, has seen steady growth. TVL now exceeds 7.2M ETH —roughly $20B at the time of writing. Of that amount, 80.6% is native staked ETH, 14% is Lido’s stETH, while more than ten other variations of liquid staking tokens (LSTs) make up the rest. The protocol has just under 137,000 unique depositors.

- EigenLayer still dominates the restaking market with an 89% share — a ~5% increase since September 2024 — gained at the expense of Symbiotic and Karak, which now hold 7.6% and 3.3%, respectively. Most of this capital rotation started to happen on the second week of January 2025.

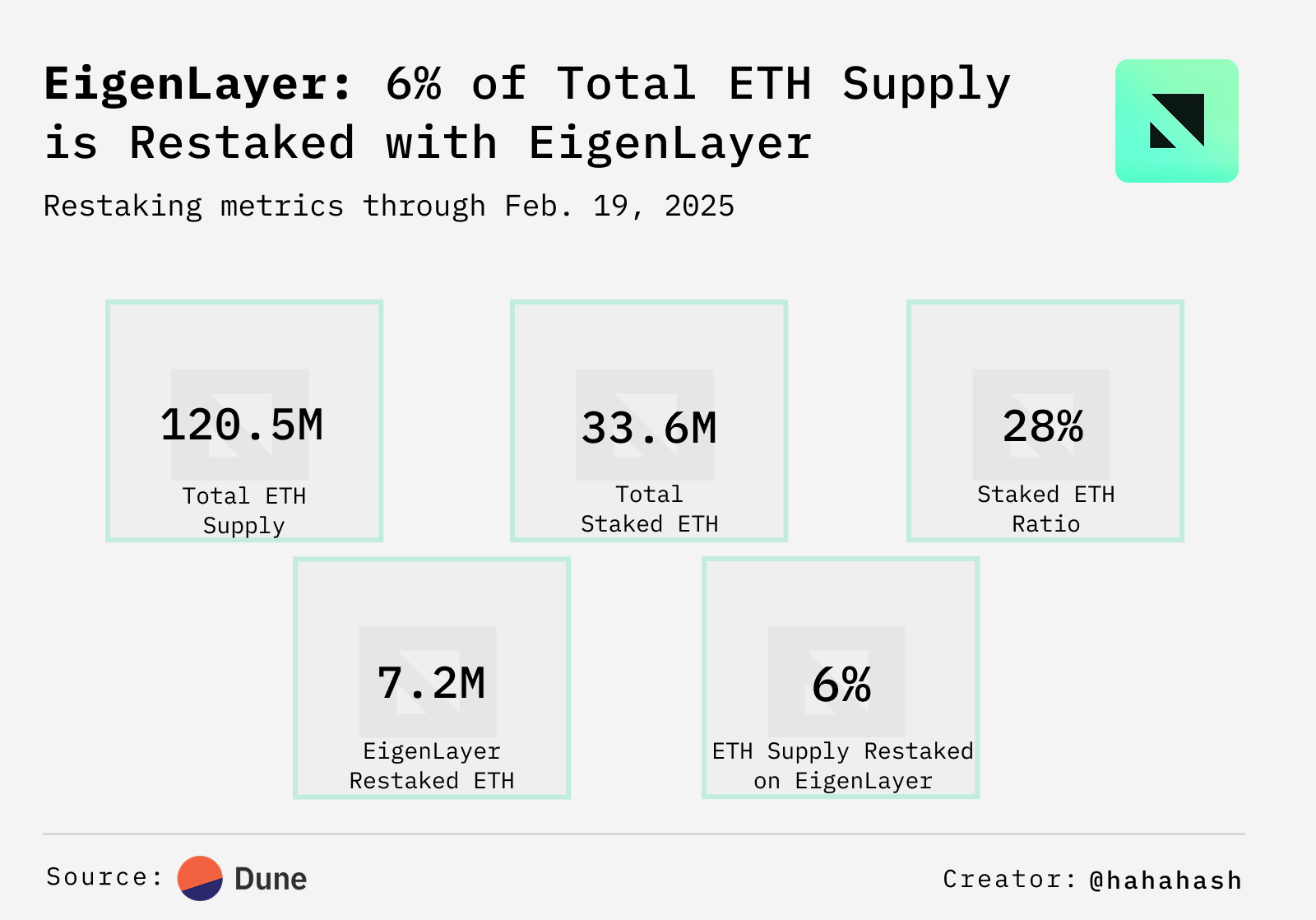

- Out of the total ETH supply of over 120M, nearly 34M ETH is staked, making up about 28%. Of that, over 7M ETH is restaked with EigenLayer — close to 6% of the total supply — demonstrating a strong commitment from depositors and node operators to the network’s security.

Symbiotic 👥

👥 okolicodes | Website | Dashboard

📈 Symbiotic Crosses 1,500 Unique Stakers Since Mainnet Launch

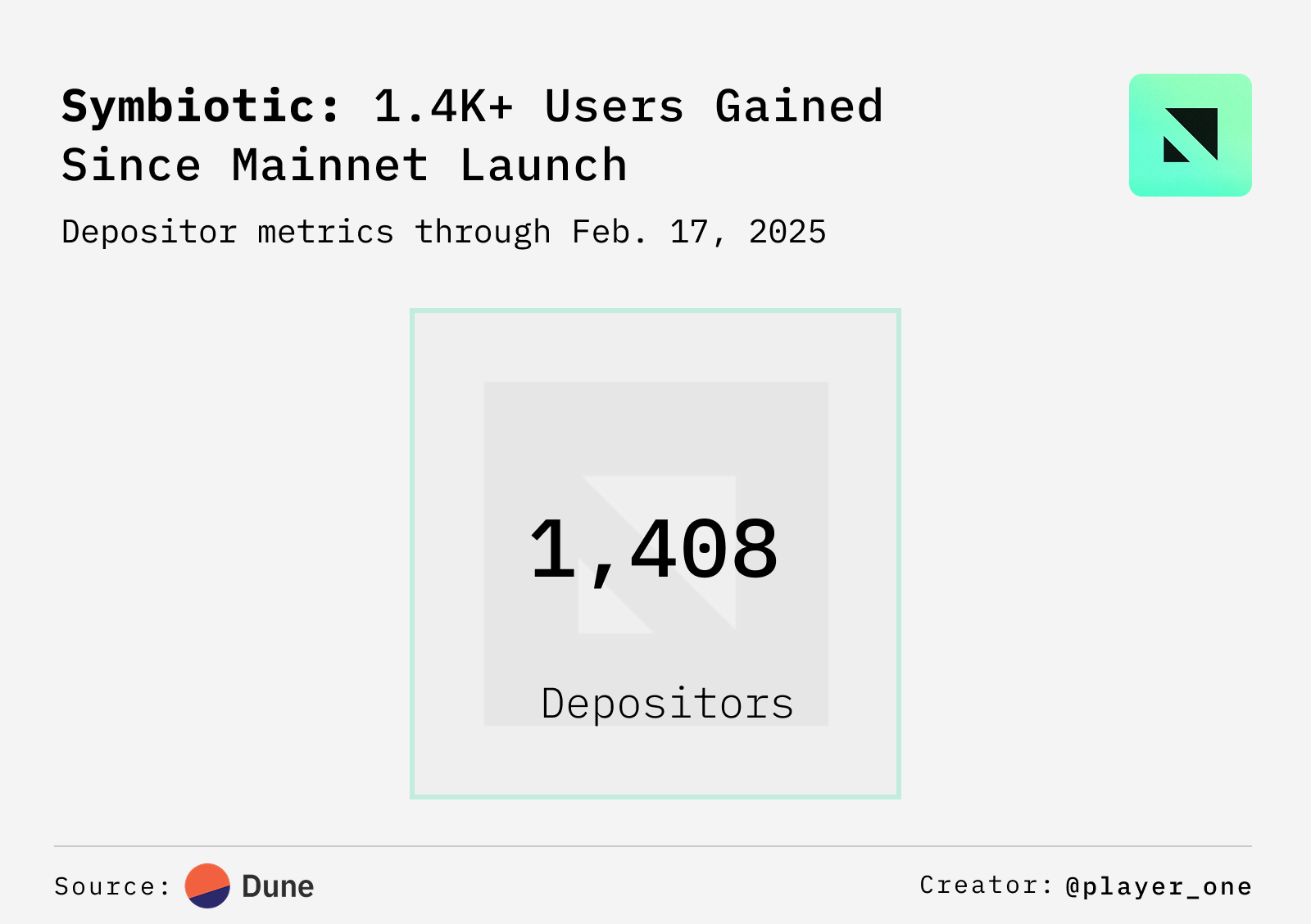

- Symbiotic is a shared security protocol designed to create a marketplace for economic security. It enables networks that need security to access it from those who have assets to stake, creating an efficient ecosystem where stake can be shared and utilized across multiple networks. Since mainnet deployment on the Jan. 28, 2025, about 1.8K users have deposited into one of Symbiotic's legacy vaults with about 1.4k of them being new to the Symbiotic Protocol.

- In a vault which holds LBTC, the liquid staked version of Bitcoin from Lombard, a total of about $45K has been deposited so far and the above chart displays the deposit amount in USD.

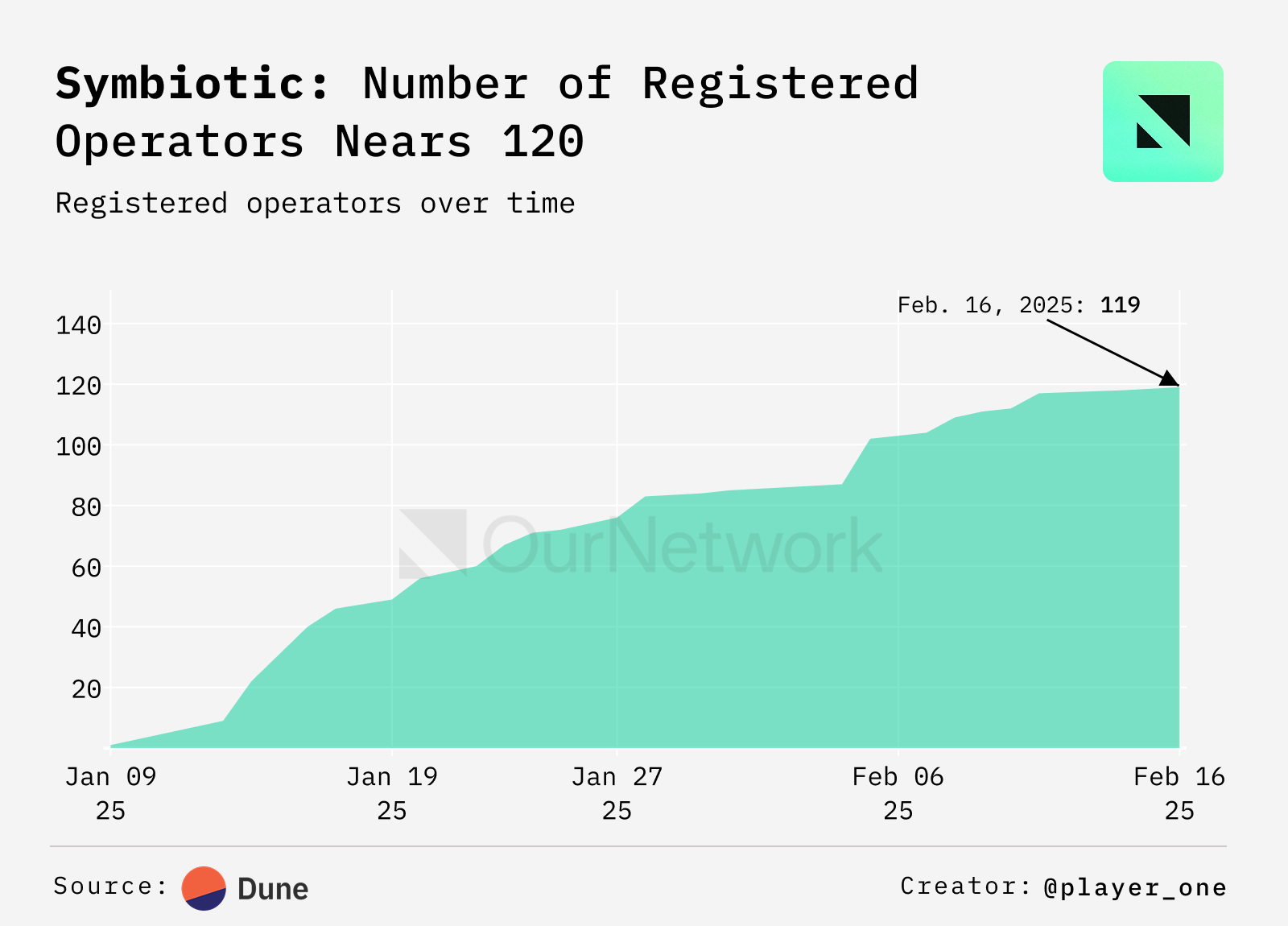

- Since January, Symbiotic has attracted 119 Operators, which are the entities running infrastructure for decentralized network within and outside of the Symbiotic ecosystem.

Swell 🌊

👥 Ian Unsworth | Website | Dashboard

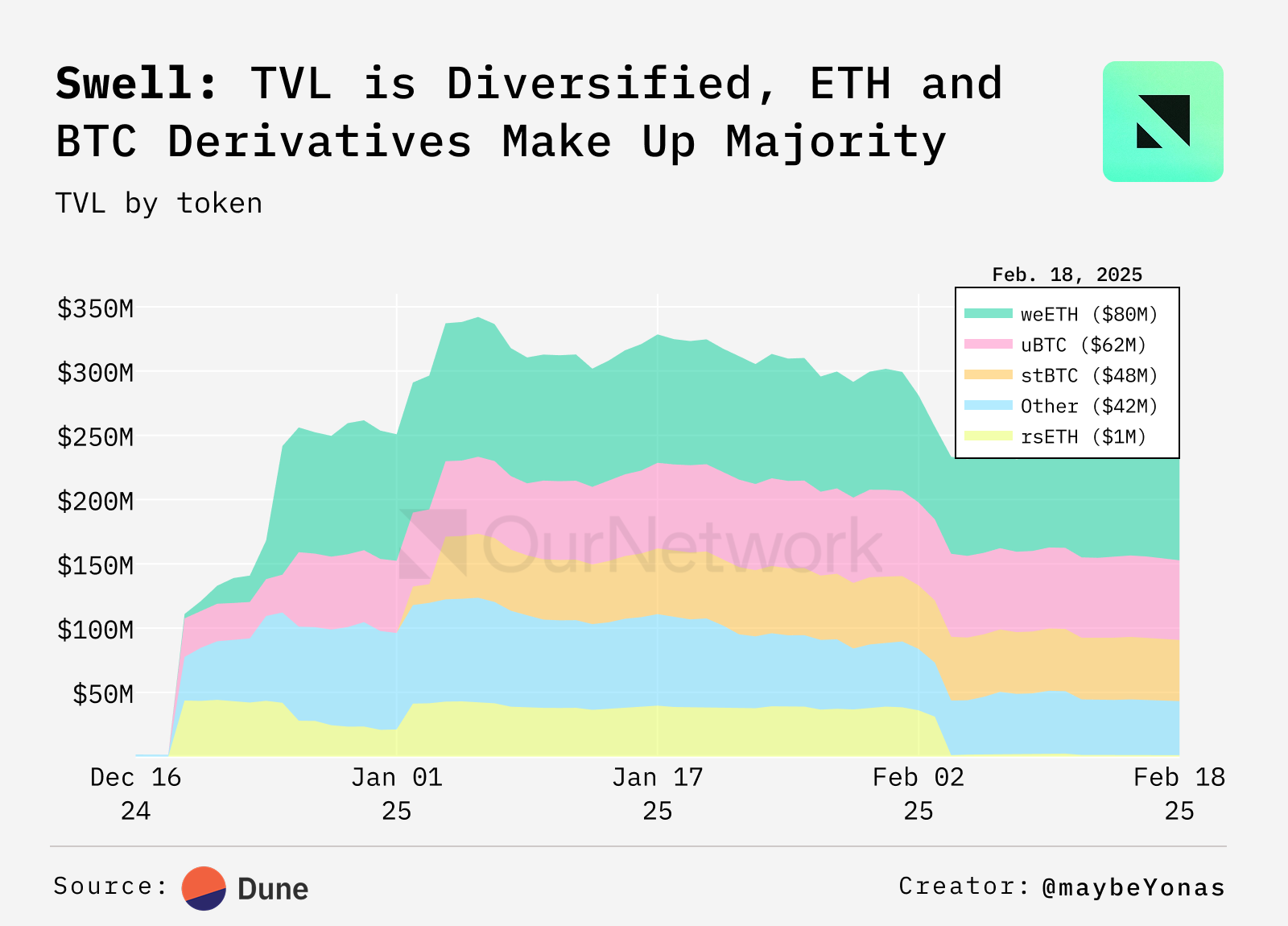

📈 Swell Chain has Quietly had 10K+ Unique Wallets Bridge Since Launching Last December, Bringing $200M+ TVL to the DeFi-focused Proof-of-Restake L2.

- Swellchain is the Layer 2 (L2) network for Swell, a non-custodial LST and liquid restaking token (LRT) provider with over $800M in TVL across all products. Swellchain itself operates as a restaking-focused Layer 2 network built on the OP Stack alongside other L2s like Base, Optimism, and Unichain. Swellchain has attracted top protocols such as Euler, the lending protocol, Ambient, the trading protocol, and soon Velodrome, the decentralized exchange (DEX), to deploy on their chain. This has allowed the chain's $230M of TVL to be productively utilized and spark economic activity on the network.

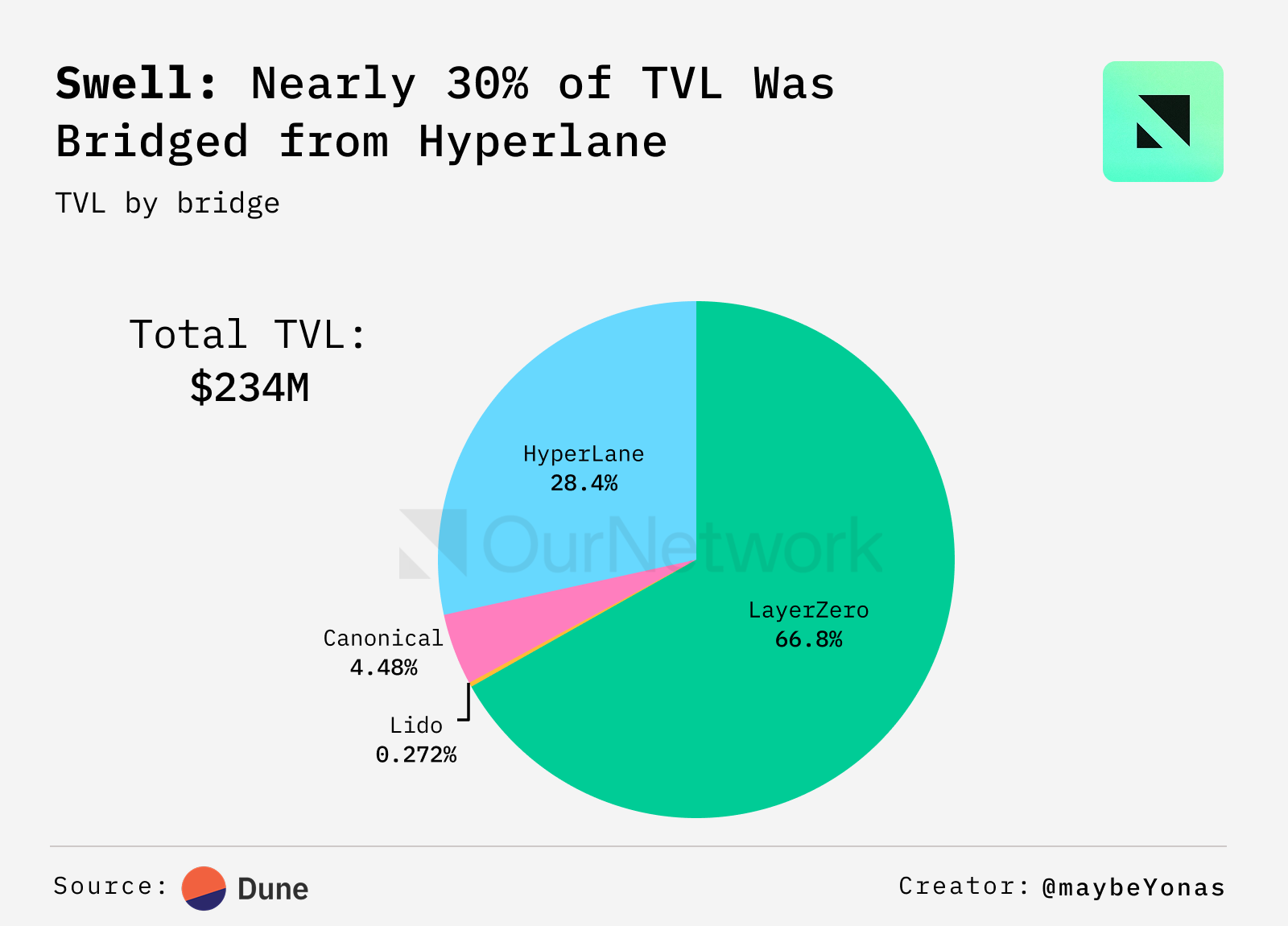

- Swellchain has unique ties to actively validated services (AVS) and networks it secures, like Ditto and Hyperlane. While its restaking products secure these services, Swell also uses them, creating harmonic incentives. For instance, approximately 30% ($67M) of Swellchain’s TVL was bridged via Hyperlane.

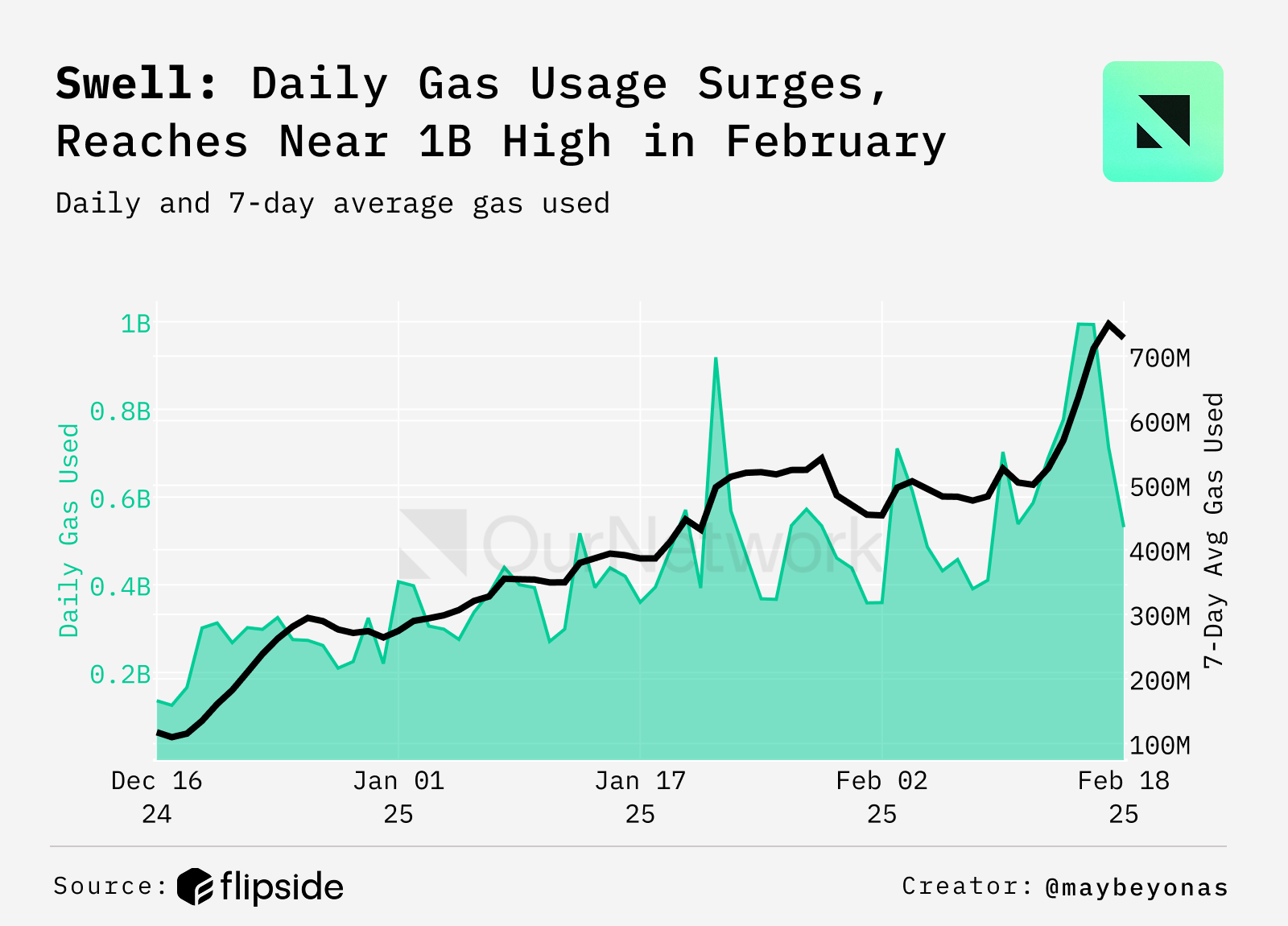

- Swellchain’s gas consumption has surged since December, with spikes tied to new protocol launches. The steady rise in daily gas used and seven-day moving average (DMA7) signals growing network demand. Continued acceleration suggests increasing adoption, reinforcing Swellchain’s role as quietly growing DeFi restaking hub.

Flipside - @maybeyonas🔦Transaction Spotlight:In less than a month after deploying on Swell on Jan. 20, Euler's WETH vault has become the largest DeFi contract on the chain, with $9.71M supplied and a 20% utilization rate. This is an interesting instance because there's only $10.56M of ETH total onchain for Swellchain. The majority of the TVL is in LRTs and other yield bearing assets, with EtherFi's weETH making up the largest chunk at 33% ($81.59M).

Ether.fi ⚙️

👥 Owen Fernau | Website | Dashboard

📈 Eigenlayer Dominates as Destination for Ether.fi Deposits

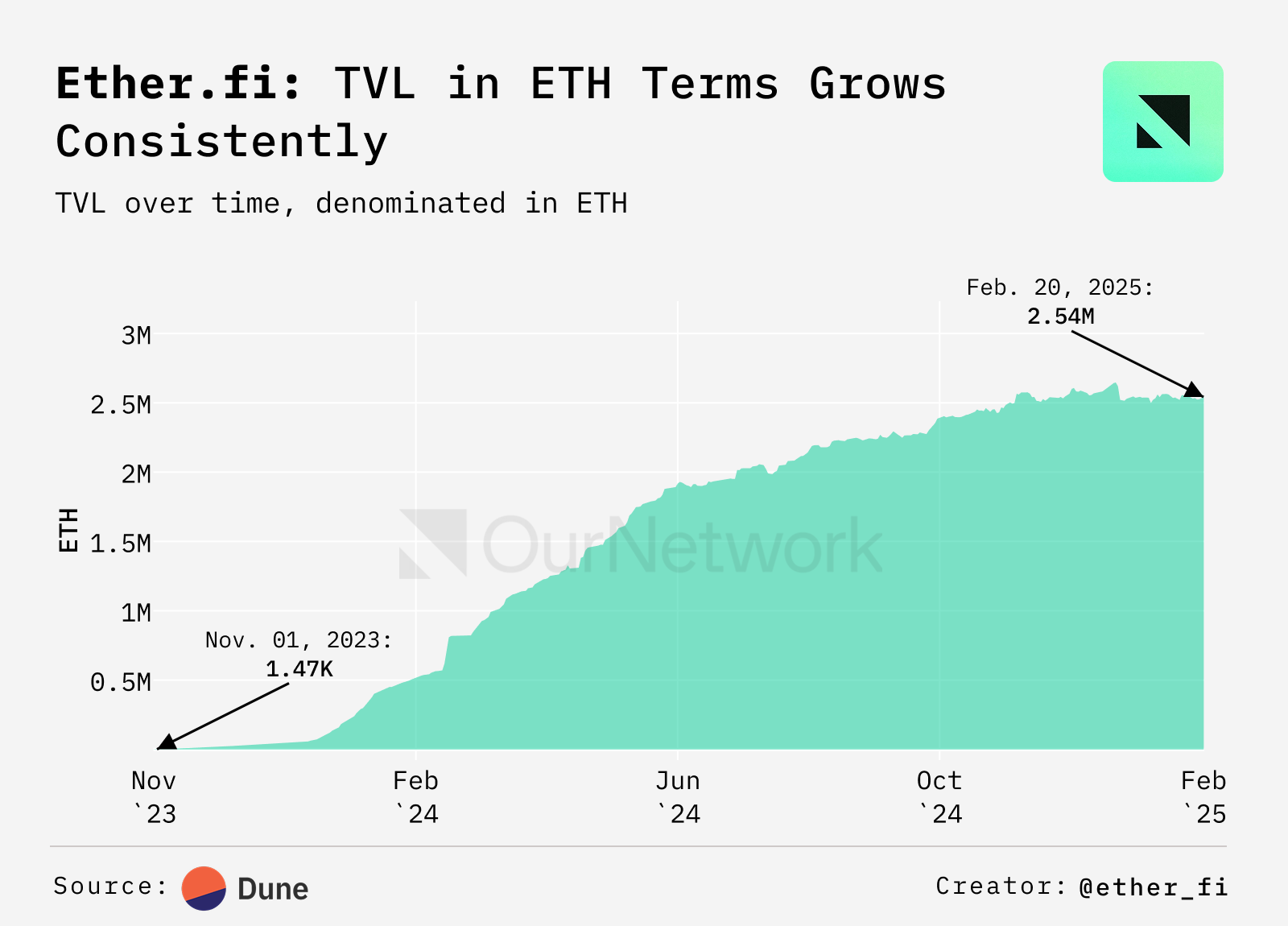

- Ether.fi is a non-custodial staking protocol whose key offering, eETH, is integrated with Eigenlayer to offer restaking rewards. The protocol reached 2.54M ETH in TVL, according to Dune Analytics. Deposits into Ether.fi are routed into different protocols — key among those is Eigenlayer, where Ether.fi's deposits constitute over 40% of the protocol's TVL. Ether.fi's deposits are also over 40% of Symbiotic's TVL, showing Ether.fi's impact in the restaking space.

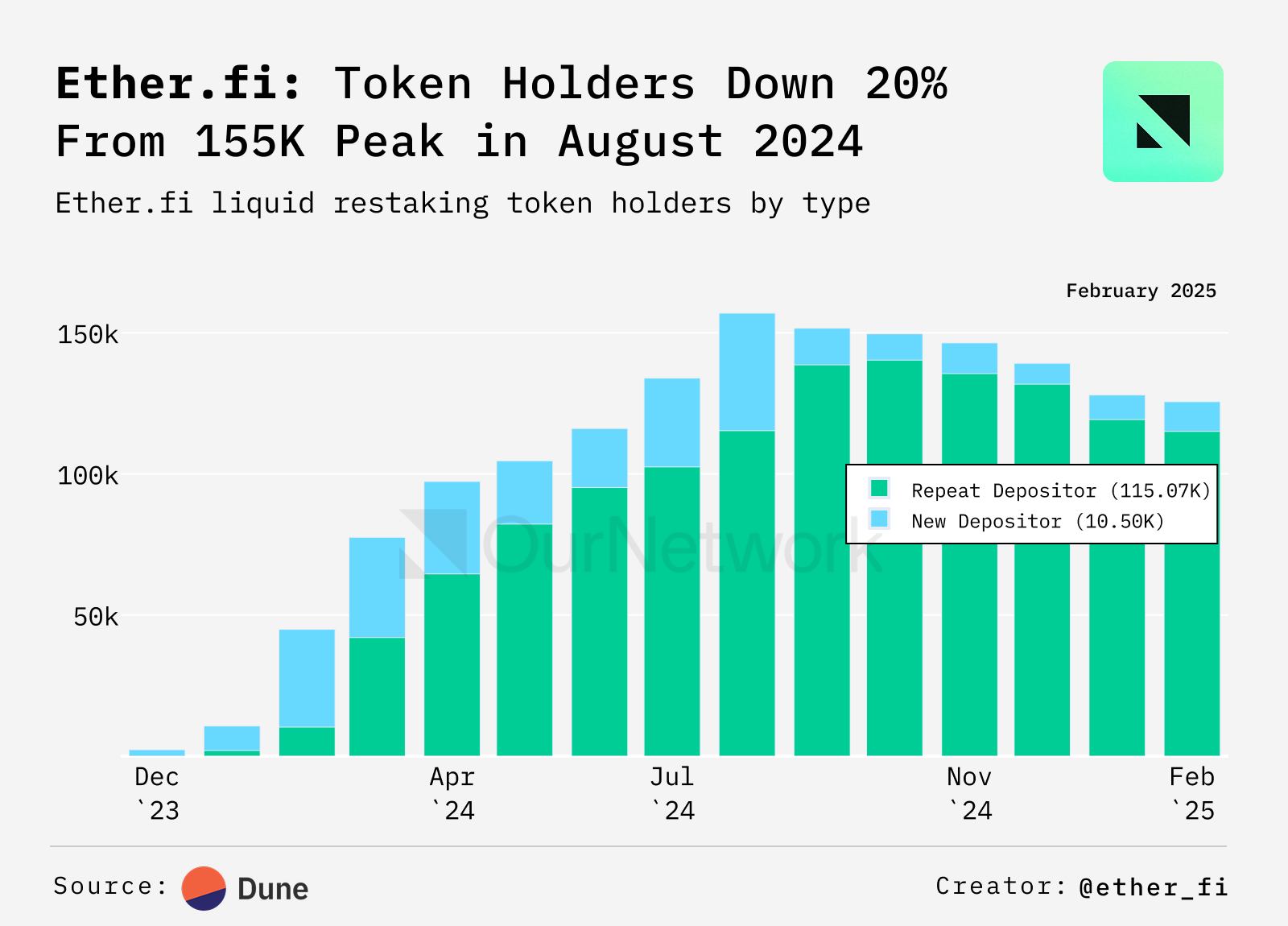

- Ether.fi experienced a steady increase holders — defined as holding at least $10 of any of the platform's LRTs — since its launch in November 2023. Unique holders peaked at 150,000 in August 2024 and have since dropped 23% to 115,000.

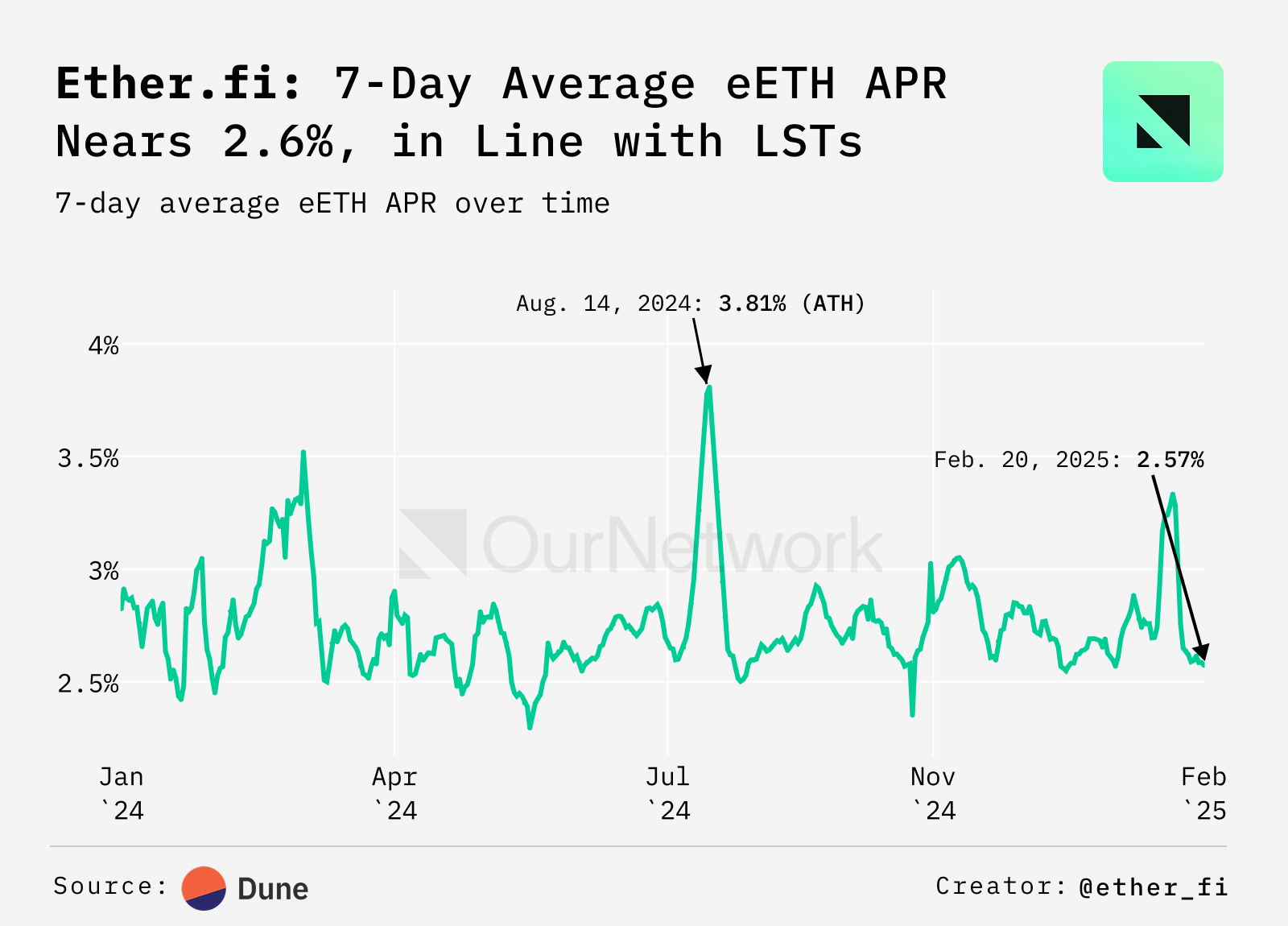

- The seven day moving average of eETH, an LRT, is at 2.6% as of Feb. 20, 2025. That's in-line with LSTs like Lido's stETH and Rocket Pool's rETH.

🔦Transaction Spotlight:This address is the top ETH depositor on Ether.fi, with 55,102 ETH — valued at $148M+ at the time of writing — restaked through EigenLayer in the eETH vault.

Solayer 🌐

👥 Oladimeji Mustapha | Website | Dashboard

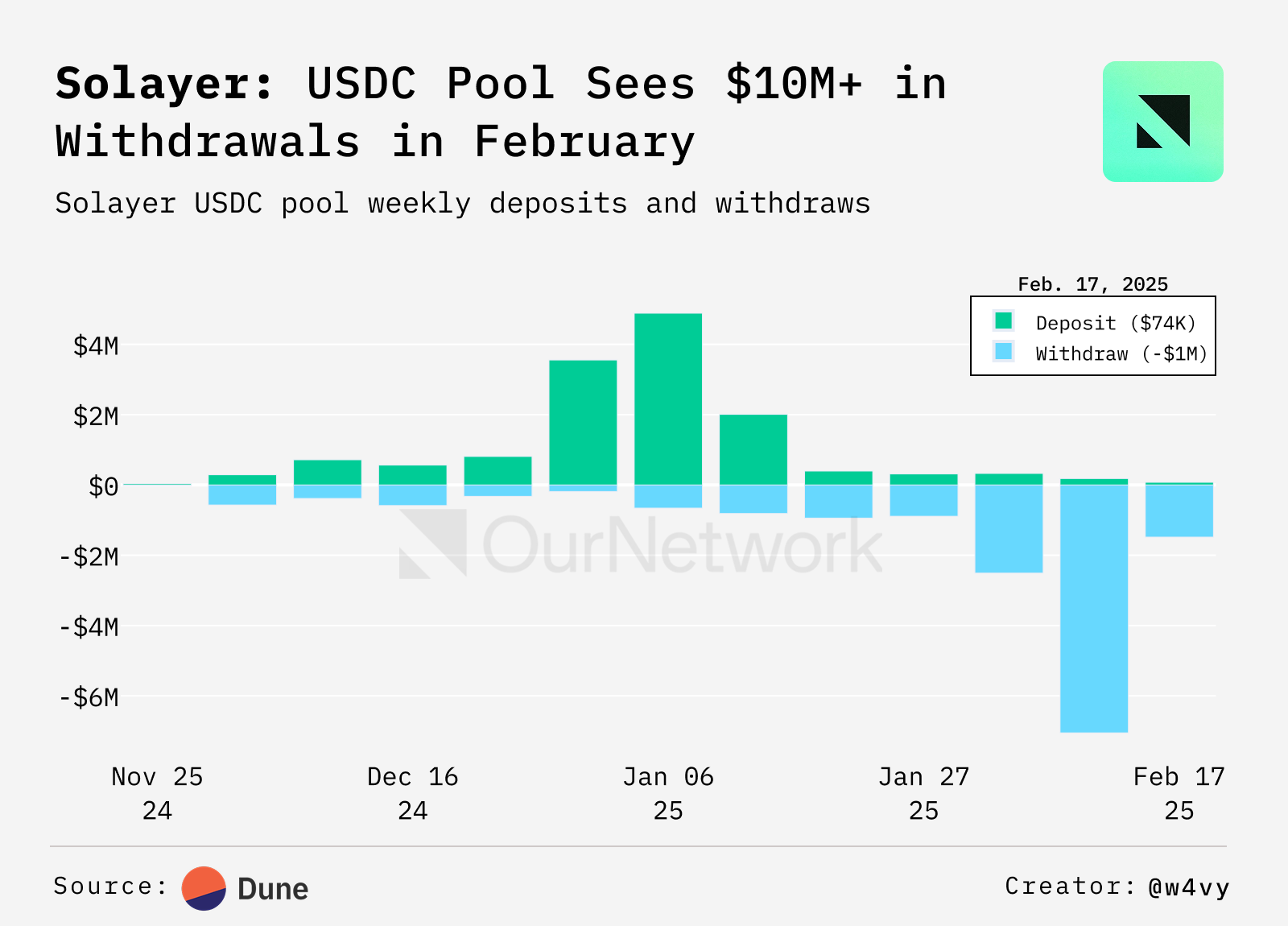

📈 Net Liquidity for the USDC pool on Solayer, a Restaking Protocol on Solana, Took a Hit in February

- In early January, Solayer’s USDC pool saw an explosion in activity, with daily active wallets skyrocketing to 1.66K users, likely driven by fresh incentives, yield opportunities, or new integrations. But just as momentum built up, February took a sharp turn, withdrawals surged, outpacing deposits and triggering a liquidity drain.

✏️Editor's Note:Solayer's USDC pool offers sUSD, a yield-bearing, U.S. dollar-pegged stablecoin. sUSD, like ETH in Eigenlayer, can be used to secure AVS, according to Solayer's website.

- These are major outflows — 1.8M+ USDC in a single day. Was this a sudden shift in sentiment, reaction to changing incentives, or a well-planned whale exit? Either way, it’s a move that raises big questions about market confidence.

🔦

All Comments