From Ecoinometrics

Bitcoin is taking the US election in strides.

Not only is the breakout above $65,000 confirmed, but BTC is pushing to new all-time highs. This is a very good dynamic. Momentum calls momentum.

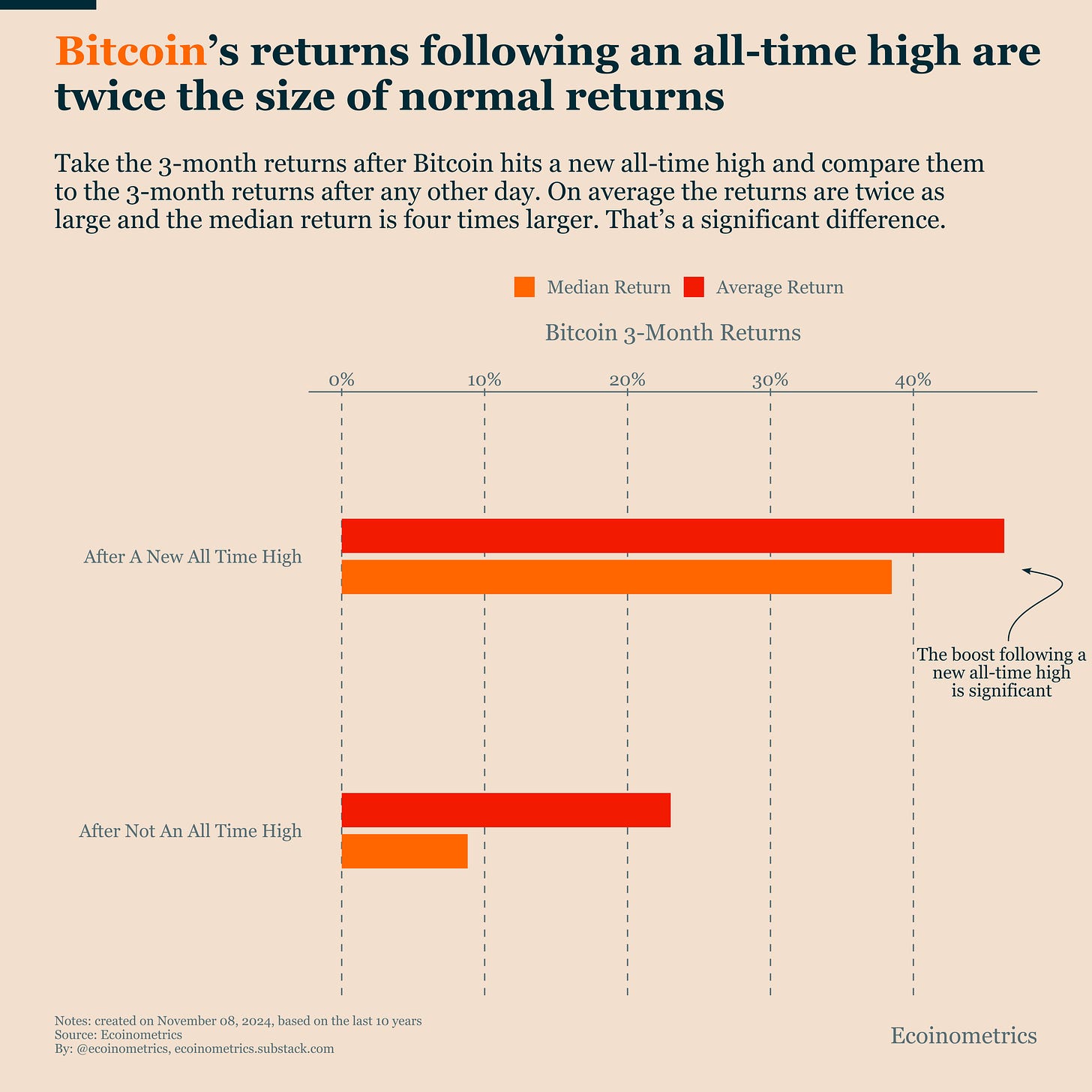

Actually you can do the math looking at historical data. The Bitcoin returns over a 3 months period that follow a new all-time high are 46% on average with a median of 39%.

What that means is if we get an average all-time high returns boost Bitcoin could be at the door of $100,000 sometimes in Q1 2025.

To get this boost all Bitcoin's need is to see enough inflows for the ETFs. For now it is looking really good. So let's keep an eye on that.

Bitcoin Over Performed In October

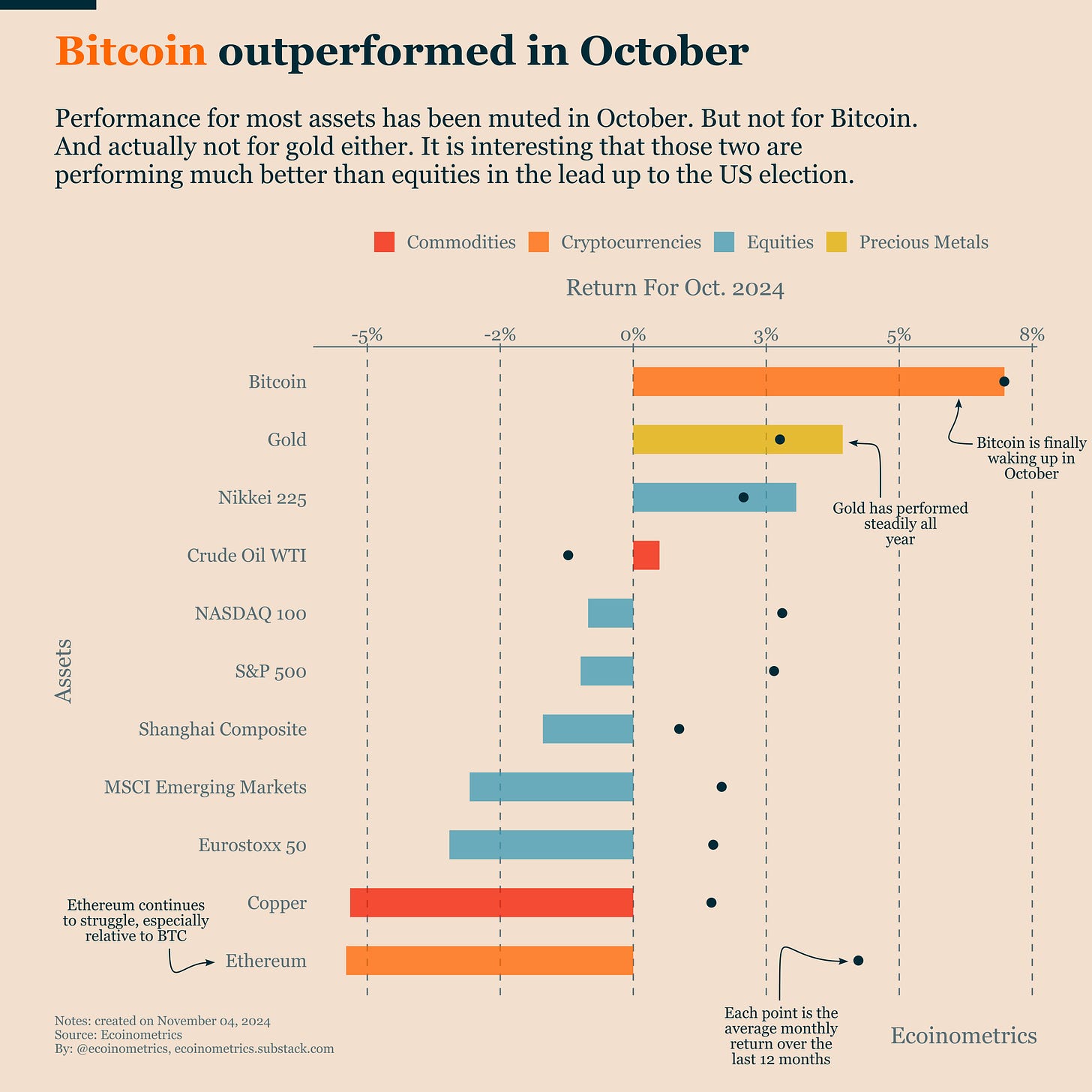

Actually even before the US presidential elections Bitcoin was already doing pretty well.

In October it was one of the few global assets to actually post positive returns. The second one being gold. This is not the first time we talk about that.

The fact that Bitcoin and gold have been performing very well for more than 12 months already tells you that global macro investors are taking the threat of the debasement of the US dollar seriously.

Unless the federal government suddenly becomes fiscally responsible, the US debt on an unsustainable trajectory. When it reaches a certain point this debt will have to be monetized by the Federal Reserve.

This is not a question of "if" but "when".

Keeping at least a fraction of your portfolio into Bitcoin is a hedge you can't afford to neglect.

Small Rate Cuts

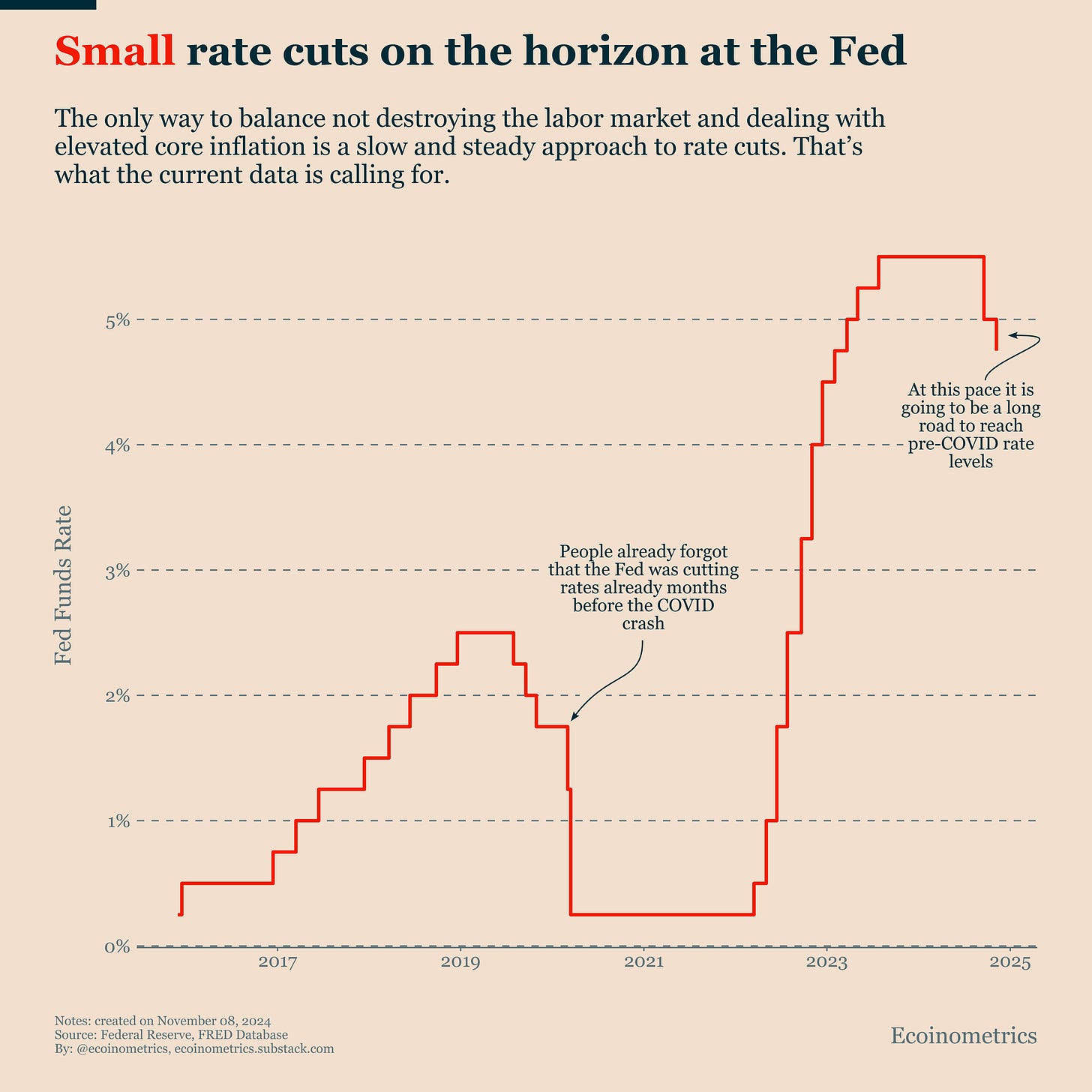

Talking about monetizing the debt, the Federal Reserve isn't doing that yet.

The more pressing issue for the Fed is to make sure core inflation stays under control without destroying the US economy at the same time.

As we have discussed on many occasions the current data shows:

- Core inflation refusing to trend down

- A stable labor market at historically low levels of unemployment

That means the only reasonable path for the Fed is to take it slow with small rate cuts in the coming months.

This is exactly what the FOMC meeting this week. And the trajectory of the balance sheet of the Fed is still declining.

You don't get a crazy growth of the monetary supply with that kind of monetary policy. But at the same time, it is not strictly negative for Bitcoin. So as long as the momentum is there for BTC, as long the ETF inflows keep coming, the actions of the Fed shouldn't change anything in the short term.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.

All Comments