From coinmetrics By: Tanay Ved & Matías Andrade

Key Takeaways:

- Since the launch of EIP-4844 on March 13th, several Layer-2 solutions, including Arbitrum, Base, and Optimism, have adopted blob transactions, with over 950,000 blobs posted to Ethereum.

- Adoption of blobs has significantly reduced operational costs for Layer-2s, with median blob fees dropping to as low as $0.0000000005, making user interactions more affordable.

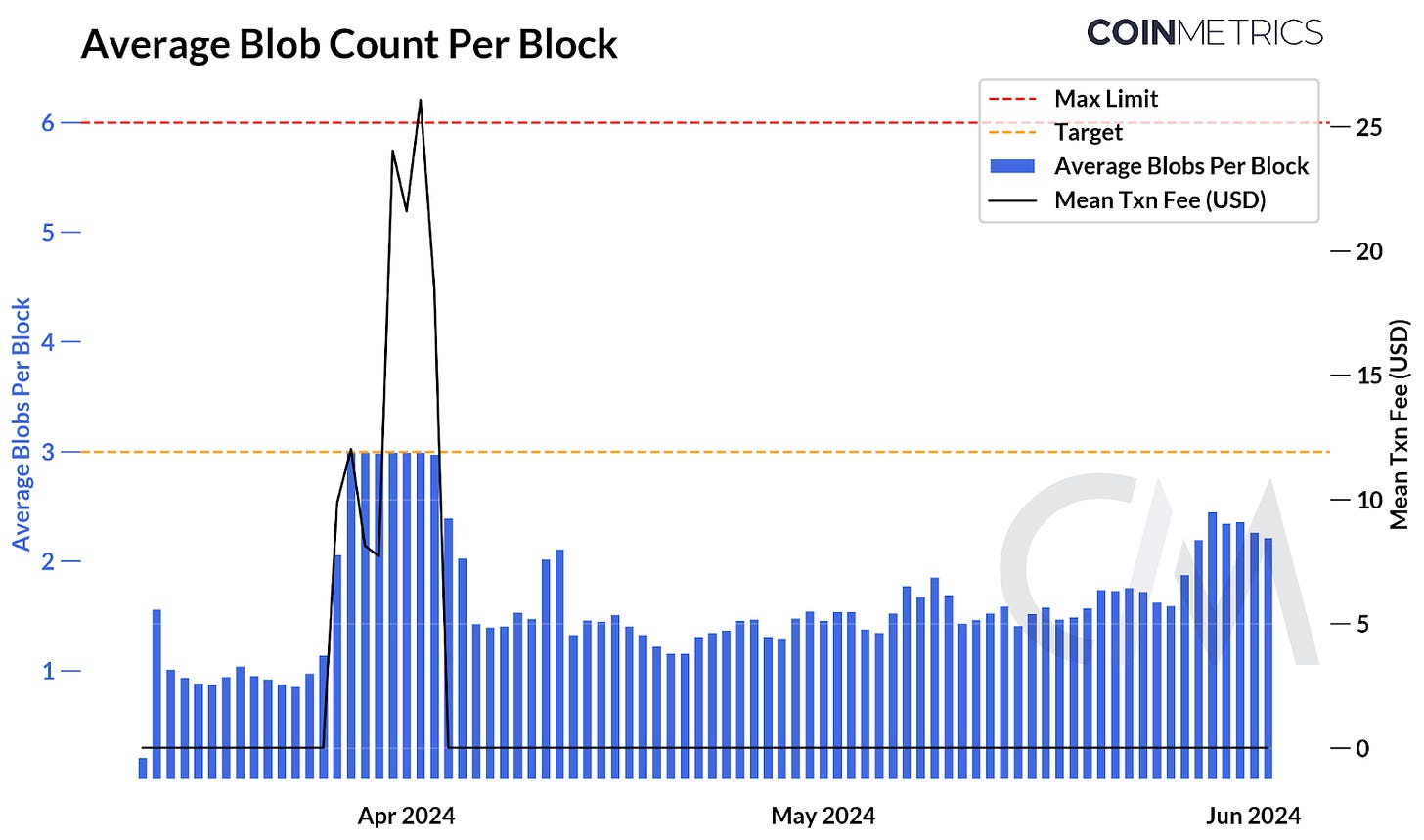

- The blob fee market dynamically adjusts based on demand, as seen when inscription blobs ("Blobscriptions") pushed average blobs per block above the target of 3, temporarily spiking fees to $27 before returning close to $0.

Introduction

EIP-4844 (dubbed “proto-danksharding”) went live with Ethereum’s Dencun upgrade in March, marking a major landmark in Ethereum’s rollup-centric roadmap. The upgrade was designed to improve the scalability of Ethereum Layer-2 solutions and reduce transaction costs by optimizing how they settle transactions to Ethereum Layer-1. This was achieved by providing a dedicated space for “blobs” of data, which L2’s can use to settle transactions more cost-effectively. Ultimately, the goal was to expand the Ethereum ecosystem’s reach by making transactions more affordable and scalable.

In this week’s issue of Coin Metrics’ State of the Network, we provide a data-driven breakdown of Layer-2 blob usage and evaluate the success of Ethereum’s EIP-4844 upgrade.

What are Blobs, Sequencers & Data Availability Layers?

As Ethereum has matured, it has transitioned into a modular blockchain, with different pieces of infrastructure working together to achieve its core functions. Layer-2’s form a piece of infrastructure in Ethereum’s stack, enabling the network to scale. Over the past few years, a vast sea of Layer-2 solutions like rollups (e.g., Base, Optimism & Arbitrum) have come into existence, with several others in development. These protocols rely on Layer-1 blockchains like Ethereum for data availability (to store/access transaction data) and ensure the settlement of transactions via actors known as sequencers, which order and batch transactions to submit to Ethereum L1. However, for Layer-2’s, the costs associated with these operations remained high.

This is where EIP-4844 comes in. The upgrade introduced a new transaction type, with blobs, temporary packets of data which can be used by L2s for cost-effective settlement. Blobs are made available for L2s for approximately 18 days—unlike the previously used calldata, which is stored permanently in Ethereum blocks. The temporary nature of blobs enable them to be priced inexpensively, thus significantly reducing storage and data costs for L2s.

In the sections ahead, we’ll understand the impacts of EIP-4844 on Ethereum's L2 ecosystem and its economics.

Adoption of Blob Transactions

After going live on March 13th, several L2’s began adopting blob transactions starting with zkSync, Starknet and Optimism. Since then, more than 950K blobs have been posted to Ethereum, of which 450K transactions carry a blob. On average, this amounts to 10K blobs through most of April, with a recent increase to 17K as more Layer-2’s enter the fray and adopt blobs.

Source: Coin Metrics Network Data Pro

Each blob carrying transaction can include up to 6 blobs, storing 128 KB of data per blob. As Layer-2 rollups increasingly adopt this dedicated space to post large amounts of data, blob space utilization is expected to increase. A total size of 125B bytes of blob space has been used thus far, and consequently, blob size is growing relative to overall block size (in bytes). This suggests that L2s are making the shift from calldata to a more efficient form of data storage. Crucially, blobs are designed to expire after 4096 epochs (~18 days), providing enough time for rollups to retrieve necessary data, while also preventing permanent storage bloat on the Ethereum network.

Source: Coin Metrics Network Data Pro, Coin Metrics Labs

The adoption of blob storage and blob transactions by Layer-2s have been relatively stable when the influence of inscriptions are excluded. While Coinbase’s Base has maintained the largest portion of blob size and blob transactions, the influence of Arbitrum is visibly on the rise. As rollups grow in number and use blobs, the number of transactions are expected to continue growing. Overall, the adoption of blobs is a positive sign, indicating that EIP-4844 is achieving its intended purpose of reducing data storage overhead and enhancing scalability for Layer-2 solutions.

Source: Coin Metrics Network Data Pro, Coin Metrics Labs

Impact on Blob Fees & Costs

The adoption of this efficient storage and transaction type, has yielded significant reductions in operational costs for L2’s. L2 sequencers incur a fee when they batch and submit blobs to Ethereum L1, which represents a cost for L2s. While weekly costs associated with Arbitrum, Base and Optimism sequencers rose to $700K in April, originating from a surge in inscription blobs, fees spent on blob space have since dropped to $0.00002.

Source: Coin Metrics Network Data Pro, Coin Metrics Labs

Increased cost-efficiency for L2s has translated to extremely low fees for end-users. Median blob fees are currently as low as $0.0000000005, falling significantly from a peak of $27, while the total amount of fees paid for blob space is near $0.000008. Ultimately, this makes user interactions like token transfers between wallets, asset swaps on DEX’s or other smart contract operations much more affordable.

Source: Coin Metrics Network Data Pro

Inscriptions & the Blob Fee Market

EIP-4844 introduced a new transaction type and a novel fee market for pricing blobs, designed to function similarly to the EIP-1559 fee market. In this new system, blob base fees adjust dynamically based on the supply and demand of blob space within each block.

The blob pricing mechanism operates according to the following principles:

- If the number of blobs in a block exceeds the current target of 3, the blob base fees increase. This is to discourage overuse of blob space and maintain a balanced supply and demand.

- If the number of blobs in a block matches the target exactly, the blob base fees remain unchanged. This indicates an equilibrium between supply and demand for blob space.

- If the number of blobs in a block falls below the target, the blob base fees decrease. This incentivizes more usage of blob space when it is underutilized.

These pricing dynamics ensure that the blob fee market adapts to the varying demand for blob space, maintaining a stable and efficient fee environment for Layer-2 solutions and users alike.

Source: Coin Metrics Network Data Pro

As depicted in the chart above, daily average transaction fees increased substantially to $27 in April as the average blobs per block exceeded the target. This increase can be attributed to a surge in inscription blobs (“Blobscriptions”). Inscriptions are a form of text, images or other media embedded in blocks—or, in this case, blobs. In late March and early April, the daily number of blobs with inscriptions rose to a high of 13K, representing over 61% of all blobs. Since then, however, the occurrence of Blobscriptions have reduced, thereby bringing blob fees back close to $0.

Source: Coin Metrics Network Data Pro, Coin Metrics Labs

This scenario illustrates how blob pricing can be impacted by network congestion or high demand for blob space. While the current target of 3 blobs per block may be increased in the future, monitoring the conditions outlined above is crucial for understanding changes in blob fee dynamics, especially as the L2 market continues to proliferate and become more competitive. Blobscriptions may have been a temporary occurrence for now, but it is likely that congestion will arise again as more L2s utilize blobs for their scalability needs.

Conclusion

EIP-4844 has successfully increased the adoption of L2s via blob transactions, reduced operational costs for Layer-2s, and made transaction fees more affordable for users. However, challenges such as frictions in bridging assets, liquidity and UX fragmentation across Layer-2 solutions, and the need for decentralizing sequencers remain. Addressing these issues will be crucial for the continued growth and success of Ethereum's Layer-2 ecosystem, enabling scalable, cost-effective transactions while maintaining security and decentralization.

All Comments